Form Ct-3-B - Tax-Exempt Domestic International Sales Corporation (Disc) Information Return - 2013 Page 5

ADVERTISEMENT

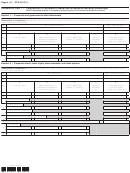

CT-3-B (2013) Page 5 of 6

Legal name of corporation

EIN

Schedule B, Part 2 — Computation of investment income before allocation

8 Interest income from investment capital in Part 1, Section 1 ...................................................................

8

9 Interest income from bank accounts

.............................................

9

(if Schedule B, line 5 is zero, enter 0 here)

10 All other interest income from investment capital ....................................................................................

10

11 Dividend income from investment capital ................................................................................................

11

12 Net capital gain or loss from investment capital ......................................................................................

12

13 Investment income other than interest, dividends, capital gains, or capital losses .................................

13

14 Total investment income

.........................................................................................

14

(add lines 8 through 13)

15 Interest deductions directly attributable to investment capital ..........

15

16 Noninterest deductions directly attributable to investment capital ...

16

17 Interest deductions indirectly attributable to investment capital .......

17

18 Noninterest deductions indirectly attributable to investment capital

18

...................................................................................................

19

19 Total deductions

(add lines 15 through 18)

20 Balance

...........................................................................................................

20

(subtract line 19 from line 14)

21 Apportioned New York NOLD ...................................................................................................................

21

22 Investment income before allocation

.............

(subtract line 21 from line 20; enter here and on page 1, line 18)

22

Schedule C, Part 1 — Income from subsidiary capital

23 Interest from subsidiary capital

................................................................................................

23

(attach list)

24 Dividends from subsidiary capital

............................................................................................

24

(attach list)

25 Capital gains from subsidiary capital

.......................................................................................

25

(attach list)

26 Total

......................................................................

26

(add lines 23 through 25; enter here and on page 1, line 10)

Schedule C, Part 2 — Computation and allocation of subsidiary capital base

Include all corporations (except a DISC) in which you own more than 50% of the voting stock. Attach separate sheets if necessary,

displaying this information formatted as below.

A — Description of subsidiary capital

(list the name of each corporation and the EIN here; for each corporation, complete columns B through G

on the corresponding lines below)

Item

Name

EIN

A

B

C

E

F

G

A

B

C

D

Net average

Issuer’s

Value allocated

Item

% of voting

Average

Liabilities directly or indirectly

value

allocation

to New York State

stock

value

attributable to

(column C – column D)

%

(column E x column F)

owned

subsidiary capital

A

B

C

Amounts from

attached list ......

27 Totals

(add

amounts in

columns C

...

27

and D)

28 Total net average value of subsidiary capital

............. 28

(add amounts in column E; enter here and on page 2, line 33)

29 Subsidiary capital base before deduction

.................................................................. 29

(add column G amounts)

30 Value of subsidiary capital included in column G of subsidiaries taxable under Tax Law Article 32;

Article 33; or Article 9, section 186 ............................................................................................................. 30

31 Subsidiary capital base

........................................................................................ 31

(subtract line 30 from line 29)

474005130094

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6