Form Ct-3-B - Tax-Exempt Domestic International Sales Corporation (Disc) Information Return - 2013 Page 3

ADVERTISEMENT

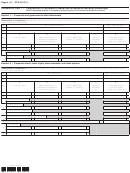

CT-3-B (2013) Page 3 of 6

Schedule A, Part 3 — Computation of business allocation

A

B

New York State

Everywhere

Receipts in the regular course of business from:

129 Sales of tangible personal property allocated to New York State ...

129

130 All sales of tangible personal property ............................................

130

131 Services performed .........................................................................

131

132 Rentals of property ..........................................................................

132

133 Royalties .........................................................................................

133

134 Other business receipts ..................................................................

134

135 Total

.........................................................

135

(add lines 129 through 134)

Schedule A, Part 4 — Computation of alternative business allocation for MTI base

A

B

New York State

Everywhere

Receipts in the regular course of business from:

149 Sales of tangible personal property allocated to New York State ...

149

150 All sales of tangible personal property ............................................

150

151 Services performed .........................................................................

151

152 Rentals of property .........................................................................

152

153 Royalties .........................................................................................

153

154 Other business receipts ..................................................................

154

155 Total

.........................................................

155

(add lines 149 through 154)

(continued)

474003130094

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6