Michigan Flow-Through Withholding - 2012 Page 13

ADVERTISEMENT

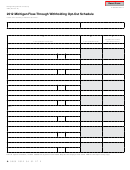

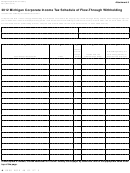

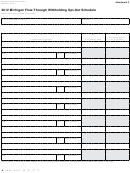

Instruction for Form 4918

Annual Flow-Through Withholding Reconciliation Return

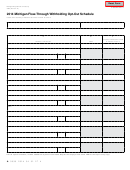

If more space is needed for Part 3 or Part 4, flow-through entities should go online to to

print out additional pages. Repeat the flow-through entity FEIN from page one at the top right of each additional page.

All pages must be submitted as part of a valid return.

beginning and ending dates (MM-DD-YYYY) that correspond to

Purpose

the taxable period included in this return.

This form is used to calculate the amount of Flow-Through

Tax year means the calendar year, or the fiscal year ending during

Withholding (FTW) due for the tax year, reconcile this amount

the calendar year, of which the withholding base of a flow-through

with the quarterly payments remitted to the state, and to distribute

entity is computed. If a return is made for a part of a year, tax year

the entire amount of FTW to the flow-through entity’s members.

means the period for which the return is made. Generally, a flow-

through entity’s tax year is for the same period as is covered by its

General Instructions

federal income tax return.

Trusts: Even though Form 4918 lists trusts as members that are

Fiscal Year Flow-Through Entities: For fiscal years ending

to be withheld on, trusts are not considered to be members of a

in 2012 your FTW tax year will be a short year and will begin

flow-through entity or flow-through entities for purposes of FTW.

January 1, 2012. The first FTW Annual Reconciliation return will

Because of this, a trust is not required to be withheld on and is not

only cover business activity that occurs after December 31, 2011.

required to withhold on its beneficiaries.

Line 2: Enter the flow-through entity’s name.

FTW on C Corporation and Intermediate Flow-Through

Line 3: Enter the flow-through entity’s Federal Employer

Entity Members: If the allocated or apportioned business income

of the flow-through entity is $200,000 or less for the flow-through

Identification Number (FEIN). Be sure to use the same account

number on all forms.

entity’s tax year, FTW is not required on members that are C

Corporations or intermediate flow-through entities. Further, if the

NOTE: The flow-through entity must register for FTW before

flow-through entity received an exemption certificate from a C

filing this form. Flow-through entities are encouraged to register

Corporation member for the tax year, FTW is not required on that

Flow-through

online

at

member. Complete this form to claim a refund of the amounts paid

entities that register with the State online receive their notification

on behalf of these members.

of the registration within seven days.

This form may not be amended: When filing this form, the

NOTE: If the flow-through entity does not have an FEIN, the

flow-through entity is required to use its “tentative business

flow-through entity must obtain an FEIN before filing. Visit

income” for the tax year. The Department recognizes that this

Treasury’s Business Taxes Web site for more information on

amount potentially will not be known with certainty at the time

obtaining an FEIN.

this form is filed. When filing this form, the flow-through entity

is required to use its best estimate of business income based on all

Returns received without a registered account number will not be

available information. If, after this form is filed, the flow-through

processed until such time as a number is provided.

entity determines that its best estimate of business income was

Line 4: Enter the flow-through entity’s complete address,

incorrect, the flow-through entity should report that difference to

including the two-digit abbreviation for the country code. See

its members. The members, when filing their respective annual

the list of country codes in the Corporate Income Tax Forms and

returns, will correct the over- or under-withholding created by the

Instructions for Standard Taxpayers (Form 4890).

over- or understatement of business income.

If the flow-through entity is unitary with a CIT taxpayer, fill

NOTE: Any refund and/or correspondence regarding the return

filed and/or refund will be sent to the address listed here. The

out the Schedule of Unitary Apportionment for Flow-Through

flow-through entity’s primary address in Treasury records,

Withholding (Form 4919), and enter the amount from line 5 of

identified as the legal address and used for all purposes other than

Form 4919 on line 11A of this form. Leave lines 5a, 5b, 5c, and

refund and correspondence on a specific FTW return, will not

10A blank. For more information on what constitutes a unitary

change unless the flow-through entity files a Notice of Change or

relationship between a flow-through entity and a CIT taxpayer, see

Discontinuance (Form 163).

the instructions for Flow-Through Entities that are Unitary with

the Taxpayer (Form 4900).

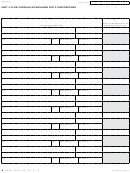

PART 1: APPORTIONMENT PERCENTAGES

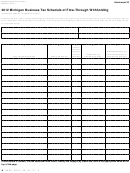

Parts 3 and 4 of this form distribute the FTW that has been paid

FOR INCOME FROM FlOW-THROuGH ENTITIES

by the flow-through entity to the flow-through entity’s members.

The flow-through entity must only withhold on business activity that

When completing Parts 3 and 4, include only those members

is allocated or apportioned to Michigan. A flow-through entity that

whose tax year ends with or within the tax year of the flow-

has not established nexus with one other state or a foreign country at

through entity that is filing this return.

the member level, as explained below, is subject to FTW on its entire

business activity. If the flow-through entity is able to apportion its

line-by-line Instructions

business income, it will be apportioned to Michigan based on sales.

For a Michigan-based flow-through entity, all sales are Michigan

Lines not listed are explained on the form.

sales unless the flow-through entity’s business activity causes its

Line 1: If not a calendar-year flow-through entity, enter the

members to be subject to tax in another state or foreign country.

13

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24