Michigan Flow-Through Withholding - 2012 Page 15

ADVERTISEMENT

use the best available information to come up with the most

Taxpayers and tax professionals are expected to be familiar with

reasonable estimate for business income at the time this form

uncommon situations within their experience, which produce

is filed. If it is later determined that the distributive income is

income not identified by specific lines on the above worksheet, and

different than what was reported on line 7A or 7B, report this

report that amount on line 7A or 7B, as applicable. Treasury may

difference to the members that have been withheld on. The

adjust the figure resulting from the worksheet to account properly

members can then account for this change when filing the CIT

for such uncommon situations.

Annual Return (Form 4891) if the member is a C Corporation or

Line 7A: Enter on this line the flow-through entity’s tentative

the Michigan Individual Income Tax Return (Form 1040) if the

distributive income that is attributable to members that are

member is an individual. The flow-through entity will not be able

intermediate flow-through entities that have been withheld on or

to amend this reconciliation return.

C Corporations, including C Corporations that have opted out of

FTW.

Use the Tentative Distributive Income Worksheet below to

calculate the flow-through entity’s tentative distributive income.

Line 7B: Enter on this line the flow-through entity’s tentative

Retain a copy of this worksheet for your files.

distributive income that is attributable to members that are

individuals, including individuals that are residents of Michigan.

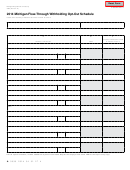

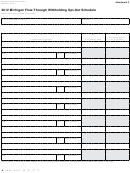

Line 8A: If the flow-through entity received an exemption

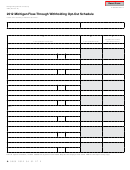

Distributive Income Worksheet

certificate from one or more C Corporation members, enter on

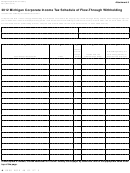

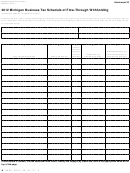

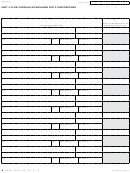

Column A is the list of amounts that are added together to total tentative distributive

income for C Corporation members that is reported on line 7A of Form 4918. Column

this line the sum of the amounts listed in column C of the Flow-

B is the list of amounts that are added together to total tentative distributive income

Through Withholding Opt-Out Schedule (Form 4920). Attach

for individual members that is reported on line 7B of Form 4918. If the flow-through

to this filing a completed Form 4920. Retain the exemption

entity is a partnership or an entity that files federally as a partnership, this information

certificates received by the flow-through entity for your records.

can be found on U.S. Form 1065, Schedule K. If the flow-through entity is an S

Corporation or an entity that files federally as an S Corporation, these amounts can

Leave this line blank if the flow-through entity did not receive an

be found on U.S. Form 1120S, Schedule K. Enter in column A only the amounts

that are attributable to members that are intermediate flow-through entities that have

exemption certificate from a member.

been withheld on or C Corporations (including C Corporations that have opted out of

FTW) as reported on the Schedule K-1 that has been issued to each member. Enter

Line 8B: Enter on this line the amount of the distributive income

in Column B only the amounts that are attributable to members that are individuals

reported on line 7B that is allocated to members that are both

— this includes resident and nonresident individuals — as reported on the Schedule

individuals and Michigan residents.

K-1 that has been issued to each member.

A

B

Line 9A: Subtract line 8A from line 7A.

Tentative

Tentative

Line 9B: Subtract line 8B from line 7B.

Distributive

Distributive

Income for C

Income for

Line 10A: If unitary with a CIT taxpayer, leave line 10A blank.

Distributive Income Categories

Corporations

Individuals

Ordinary income (loss) from trade or

Line 11A: If the flow-through entity is unitary with a CIT

business activity

taxpayer, the flow-through entity must complete the Schedule

Net income (loss) from rental real estate

activity

of Unitary Apportionment for Flow-Through Withholding

Net income (loss) from other rental

(Form 4919). Enter on this line the amount entered on line 5 of

activity

Form 4919. Include a completed Form 4919 with this Annual

Reconciliation.

Portfolio income (loss):

If the flow-through entity is unitary with a CIT taxpayer, leave

Interest income

line 10A blank. If the flow-through entity is not unitary with a CIT

Dividend income

taxpayer, leave line 11A blank.

Royalty income

For a further explanation of what constitutes a unitary

relationship, see the instructions to Form 4900.

Net short-term capital gain (loss)

Line 12B: A flow-through entity with a calendar tax year ending

Net long-term capital gain (loss)

in 2012 will use the tax rate of 4.33 percent. A flow-through entity

XXXXXXXX

*

Guaranteed payments

with a fiscal tax year ending in 2013 will use the tax rate of 4.25

percent.

Net gain (loss) under section 1231

Line 13A: If the flow-through entity is not unitary with a CIT

Other income (loss)

taxpayer, multiply line 12A by line 10A. If the flow-through entity

TOTAl DISTRIBuTIvE INCOME

is unitary with a CIT taxpayer, multiply line 12A by line 11A. If

Add all amounts in Column A and carry

less than zero, enter zero.

to Form 4918, line 7A. Add all amounts

in Column B and carry to Form 4918,

NOTE: The sum of all of the amounts entered on line 21B may

line 7B.

not be greater than the amount entered on this line.

*

Guaranteed payment as defined under the Internal Revenue Code of 1986 Section

707(c) is determined to be compensation for services rendered or for the use of capital

Line 13B: Multiply line 12B by line 10B. If less than zero, enter

a distributive share of the partnership’s profits. The payment, to the extent included

zero.

in federal adjusted gross income, is characterized as compensation or interest on

the individual’s return. A nonresident partner is taxed on a guaranteed payment to

NOTE: The sum of all of the amounts entered on line 22E may

the extent the payment is includable in federal adjusted gross income and is for

not be greater than the amount entered on this line.

compensation received for personal services performed in this State. A guaranteed

payment for the use of capital is allocated to the nonresident partner’s state of domicile.

Line 15: Enter the total FTW paid with the FTW Quarterly Tax

15

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24