Michigan Flow-Through Withholding - 2012 Page 14

ADVERTISEMENT

A flow-through entity will cause its C Corporation and

Line 5b: Enter the total sales, as defined for members that are

C Corporations or intermediate flow-through entities, that are

ntermediate flow-through entity members to be subject to a tax at

i

directly attributable to the flow-through entity.

the member level in another state or foreign country if the entity’s

business activity is subject to a business privilege tax, a net

Transportation services that source sales based on revenue

income tax, a franchise tax measured by net income, a franchise

miles: Enter on this line the total sales, as defined for members

tax for the privilege of doing business, a corporate stock tax; or

that are C Corporations or intermediate flow-through entities, that

if the state or foreign country has jurisdiction to subject the flow-

are directly attributable to the flow-through entity.

through entity entity’s business activity to one or more of the

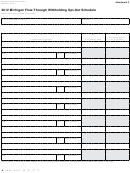

Line 6: When calculating the sales factor to use for members that

above listed taxes at the member level, regardless of whether the

tax is imposed.

are individuals, “sale or sales” means all gross receipts of the

taxpayer not allocated under IIT sections MCL 206.110 through

A flow-through entity will cause its nonresident individual

MCL 206.114. Sale or sales includes gross receipts from sales of

members to be subject to a tax at the member level in another

tangible property, rental of property, and providing of services that

state or foreign country if the entity’s business activity is subject

constitute business activity. Exclude all receipts from nonbusiness

to a net income tax, a franchise tax measured by net income, a

income.

franchise tax for the privilege of doing business, or a corporate

stock tax; or if that state or foreign country has jurisdiction to

NOTE: Throwback sales for individual income tax follow federal

P.L. 86-272 standards. The business must have physical presence

subject the flow-through entity entity’s business activity to a net

in the other state or activity beyond solicitation of sales in order

income tax at the member level, regardless of whether, in fact, the

to exclude sales into another state or country from the numerator.

state does or does not.

The Michigan income tax act definition of “state” includes a

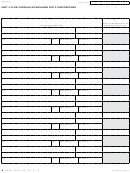

Line 5: When calculating the sales factor to use for members that

foreign country. Therefore, foreign sales are considered Michigan

are C Corporations or intermediate flow-through entities, sale or

sales unless the business entity is taxable in the foreign country.

sales means the amounts received by the flow-through entity as

Sales of tangible personal property are in this state if:

consideration from the following:

• The property is shipped or delivered to a purchaser (other than

• The transfer of title to, or possession of, property that is stock

the United States government) within Michigan regardless of the

in trade or other property of a kind which would properly be

free on board (F.O.B.) point or other conditions of the sale, or

included in the inventory of the flow-through entity if on hand at

the close of the tax period, or property held by the flow-through

• The property is shipped from an office, store, warehouse,

entity primarily for sale to customers in the ordinary course of its

factory or other place of storage in Michigan and the purchaser is

trade or business. For intangible property, the amounts received

the United States government or the taxpayer is not taxable in the

state of the purchaser.

will be limited to any gain received from the disposition of that

property.

Sales other than of tangible personal property are in Michigan if:

• Performance of services which constitute business activities.

• The business activity is performed in Michigan, or

• The rental, leasing, licensing, or use of tangible or intangible

• The business activity is performed both in Michigan and

property, including interest, that constitutes business activity.

in another state(s), but based on cost of performance, a greater

• Any combination of business activities described above.

proportion of the business activity is performed in Michigan.

• For flow-through entities not engaged in any other business

Line 6a: Enter the Michigan sales, as defined for members that are

activities, sales include interest, dividends, and other income

individuals, that are attributable to the flow-through entity. Include

from investment assets and activities and from trading assets and

on this line any “throwback sales” of the flow-through entity.

activities.

Transportation services that source sales based on revenue

Complete the Apportionment Calculation using amounts for

miles: Enter on this line the flow-through entity’s total sales, as

the flow-through entity’s business activity only. Do not include

defined for members that are individuals, multiplied by the ratio

amounts received from a profits interest in a Partnership, S

Corporation, or LLC.

of Michigan revenue miles over revenue miles everywhere as

provided in the “Sourcing of Sales to Michigan” chart in Form

Use the information in the “Sourcing of Sales to Michigan”

4890 for that type of transportation service. Revenue mile means

section in Form 4890 to determine Michigan sales for members

the transportation for consideration of one net ton in weight or one

that are C Corporations or intermediate flow-through entities.

passenger the distance of one mile.

Line 5a: Enter the Michigan sales, as defined for members that

Line 6b: Enter the total sales, as defined for members that are

are C Corporations or intermediate flow-through entities, that are

individuals, that are directly attributable to the flow-through

attributable to the flow-through entity.

entity.

Transportation services that source sales based on revenue

Transportation services that source sales based on revenue

miles: Enter on this line the flow-through entity’s total sales, as

miles: Enter on this line the total sales, as defined for members

defined for members that are C Corporations or intermediate

that are individuals, that are directly attributable to the flow-

flow-through entities, multiplied by the ratio of Michigan

through entity.

revenue miles over revenue miles everywhere as provided in the

PART 2: TENTATIvE DISTRIBuTIvE INCOME

“Sourcing of Sales to Michigan” chart in Form 4890 for that type

of transportation service. Revenue mile means the transportation

Line 7: Because this reconciliation return is required to be filed

before the flow-through entity’s federal form, Treasury recognizes

for consideration of one net ton in weight or one passenger the

distance of one mile.

that this amount will be “tentative.” When completing this form,

14

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24