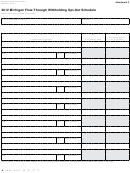

Michigan Flow-Through Withholding - 2012 Page 20

ADVERTISEMENT

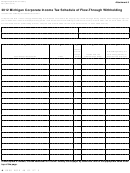

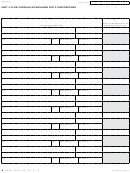

through entity and the CIT taxpayer that is unitary with the

flow-through entity. The total sales used when calculating the

unitary sales factor for a CIT taxpayer that is unitary with the

flow-through entity includes all of the sales of the CIT taxpayer

and a proportionate amount of the flow-through entity’s

total sales. This can be calculated using the equation for the

denominator included above in the General Instructions.

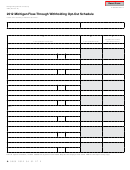

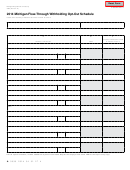

Line 2a: Enter the Michigan sales that are directly attributable

to the flow-through entity. Do not include any sales that are

attributable to the flow-through entity’s members.

Line 2b: Enter the total sales that are directly attributable to

the flow-through entity. Do not include any sales that are

attributable to the flow-through entity’s members.

Line 3a: Enter on this line the distributive share of the flow-

through entity’s business income that is attributable to the

CIT taxpayer that is unitary with the flow-through entity. The

amount entered on this line combined with the amount entered

on Line 3b must equal the amount entered on Line 9a of Form

4918.

Line 3b: Enter on this line the distributive share of the flow-

through entity’s business income that is attributable to

members that are C Corporations that are not unitary with the

flow-through entity and members that are other flow-through

entities. The amount entered on this line combined with the

amount entered on Line 3a must equal the amount entered on

Line 9a of Annual Flow-Through Reconciliation Return (Form

4918).

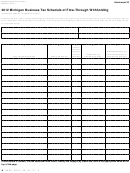

Line 4a: Multiply Line 3a by Line 1c and enter that amount on

this line.

Line 4b: Multiply Line 3b by Line 2c and enter that amount on

this line.

Line 5: Add Line 4a and Line 4b. Enter this amount on this line

and carry this amount to Line 11a of Form 4918.

Include completed Form 4919 as part of the tax return filing.

20

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24