Instructions For Form Mo-1040p - Property Tax Credit/ Pension Exemption Short Form - 2012 Page 14

ADVERTISEMENT

percent. If two or more unmarried

Information to

Helpful Hint

individuals over 18 years of age share

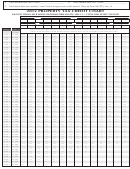

Your property tax credit is figured by

Complete

residence and each pay part of the

comparing your total income received

rent, enter the total rent on Form

Form MO-CRP

to 20 percent of your net rent paid

MO-CRP, Line 6 and mark the appro-

or real estate tax paid. To make the com-

priate percentage on box G of Line 7.

parison and determine your credit, use

If you rent from a tax exempt

the rent receipt is for the total rent

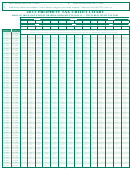

the 2012 Property Tax Credit Chart on

facility, you do not qualify.

amount, then the percentage on box

pages 29 through 31. Lines are provided

on the chart to help you figure this amount.

G of the Form MO-CRP must be used

s

1

Example: Ruth paid $1,200 in real estate

tEP

to determine your credit.

tax and her total household income

Enter all information requested on

s

4

tEP

was $15,000. Ruth will apply her tax

Lines 1–5. If rent is paid to a relative,

paid and her total household income

Multiply Line 6 by the percentage on

the relationship to the landlord must

to the chart to figure out her credit amount.

Line 7. Enter this amount on Form

be indicated on Line 1. Your claim

Even though Ruth paid $1,200 in real

MO-CRP, Line 8.

may be delayed if you fail to enter all

estate tax, she is only allowed to take a

credit of $1,100. Ruth will use $1,100

required information.

s

5

tEP

as tax paid and her total household

s

2

income of $15,000 to make the com-

tEP

Multiply Line 8 by 20 percent and

parison. When using the chart, Ruth

enter the result on Line 9. Add the

Enter on Line 6 the gross rent paid.

finds where $15,000 and $1,100 “meet”

totals from Line 9 on all completed

Exclude rent paid for any portion of

to figure her credit. The two numbers

Forms MO-CRP and enter the amount

your home used in the production

“meet” on the chart where the credit

on Line 12 of MO-PTS.

of income, and the rent paid for

amount is $1,059. Ruth will get a $1,059

surrounding land with attachments

credit for the real estate tax she paid.

Helpful Hints

not necessary nor maintained for

• An apartment is a room or suite of

homestead purposes. Also, exclude

If you have the same address as your

rooms with separate facilities for

any rent paid to your landlord on

landlord, please verify the number of

cooking and other normal household

your behalf by any organization or

functions.

occupants and living units.

agency.

• A boarding home is a house that

l

13 — t

R

InE

otAl

EAl

provides meals, lodging, and the

s

3

tEP

E

t

/R

P

residents share common facilities.

stAtE

Ax

Ent

AId

If you were a resident of a nursing

Add amounts from Form MO-PTS,

home or boarding home during 2012,

Lines 11 and 12 and enter amount on

use the applicable percentage on Line

Line 13, or $1,100, whichever is less.

7. If you live in a hotel and meals

Example: Ester owns her home for

are included in your rent payment,

three months and pays $100 in property

enter 50 percent; otherwise enter 100

taxes. For nine months she rents an

apartment and pays $4,000 in rent.

The amount on Line 9 of the MO-CRP

is $800 ($4,000 x 20%). Form MO-PTS,

Diagram 1: Form W-2

Line 11, is $100; Line 12 is $750; and

Line 13 is $850. The $800 for rent is

limited on Line 12 to $750.

l

14 — P

InE

RoPERty

t

C

Ax

REdIt

Apply Lines 10 and 13 to the Prop-

erty Tax Credit Chart on pages 29-31

to determine the amount of your prop er ty

tax credit and enter amount on Line 14.

If you have another income tax or

property tax credit liability, this prop-

Earnings Tax

Missouri Taxes Withheld

erty tax credit may be applied to that

liability in accordance with Section

143.782, RSMo. You will be notified

if your credit is offset against any debts.

2012

14

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30 31

31 32

32