Instructions For Form Mo-1040p - Property Tax Credit/ Pension Exemption Short Form - 2012 Page 20

ADVERTISEMENT

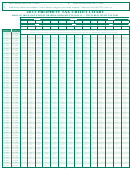

FORM MO-1040P

00

14

14. Total Missouri taxable income amount from Line 13. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Yourself

Spouse

15. Multiply Line 14 by the percentages you determined on Line 5.

00

00

15Y

15S

Do this for you and your spouse. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

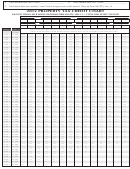

16. Use the tax table on page 18 or 22 of the instructions to figure the

00

00

16Y

16S

tax on amounts from Line 15 for you and your spouse. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

00

17

17. TOTAL TAXES — Add your tax and your spouse’s tax from Line 16.. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

18. Missouri withholding for you and your spouse from your Forms W-2 and 1099.

00

18

Attach copies of Forms W-2 and 1099. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

19. Any Missouri estimated tax payments for 2012 (Be sure to include

00

19

any amount of your 2011 overpayment credited to your 2012 Missouri tax return.) . . . . . . . . . . . . . . . . . . . .

Attach

Form MO-PTS.

20. PROPERTY TAX CREDIT — Enter amount from Form MO-PTS,

00

20

Line 14. Attach Form MO-PTS. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

21. TOTAL PAYMENTS AND CREDITS

00

21

Add Lines 18, 19, and 20 and enter amount here. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2 2. If amount of TOTAL PAYMENTS AND CREDITS (Line 21) is larger than amount of

TOTAL TAXES (Line 17), enter the difference here. You have overpaid.

00

22

If not, enter the amount on Line 26. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

00

23

2 3. Enter the amount from Line 22 you want applied to your 2013 estimated tax.. . . . . . . . . . . . . . . . . . . . . . . .

24.

Enter the amount of

G

your donation in the

eneral

Additional

Additional

Workers

LEAD

R

evenue

Fund Code

Fund Code

trust fund boxes to the

Missouri

Missouri

(See Instr.)

(See Instr.)

Children’s

Veterans

Childhood

Elderly Home

National Guard

Workers’

Military

General

After School

right. See instructions

Trust Fund

Trust Fund

Lead Testing

Organ Donor

Delivered Meals

Family Relief

Trust Fund

Memorial

Revenue

Retreat Fund

______|______

______|______

Fund

for trust fund codes.

Trust Fund

Program Fund

Fund

Fund

Fund

00

00

00

00

00

00

00

00

00

00

00

00

24.

25. REFUND - Subtract Lines 23 and 24 from Line 22 and enter here. This is your refund. Sign below and

mail to: Department of Revenue, P.O. Box 2800, Jefferson City, MO 65105-2800.

00

25

Check the box if you want your refund issued on a debit card. See instructions for Line 25.. . Debit Card

26. AMOUNT DUE - If Line 21 is less than Line 17, enter the difference here. You have an amount due.

Sign below and mail to: Department of Revenue, P.O. Box 3395, Jefferson City, MO 65105-3395.

00

26

See instructions for Line 26. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

If you pay by check, you authorize the Department of Revenue to process the check electronically.

Any check returned unpaid may be presented again electronically.

Under penalties of perjury, I declare that I have examined this return, including accompanying schedules and statements, and to the best of my knowledge and belief it is true,

correct, and complete. Declaration of preparer (other than taxpayer) is based on all information of which he or she has any knowledge. As provided in Chapter 143, RSMo, a penalty

of up to $500 shall be imposed on any individual who files a frivolous return. I also declare under penalties of perjury that I employ no illegal or unauthorized aliens as defined under

federal law and that I am not eligible for any tax exemption, credit or abatement if I employ such aliens.

E-MAIL ADDRESS

PREPARER’S PHONE NUMBER

I authorize the Director of Revenue or delegate to discuss my return and

attachments with the preparer or any member of the preparer’s firm.

X

(__ __ __)__ __ __-__ __ __ __

YES

NO

SIGNATURE

DATE (MMDDYYYY)

PREPARER’S SIGNATURE

FEIN, SSN, OR PTIN

__ __/__ __/__ __ __ __

(if filing combined BOTH must sign)

SPOUSE’S SIGNATURE

DAYTIME TELEPHONE

PREPARER’S ADDRESS AND ZIP CODE

DATE (MMDDYYYY)

(__ __ __)__ __ __-__ __ __ __

__ __/__ __/__ __ __ __

MO-1040P (12-2012)

20

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30 31

31 32

32