Instructions For Form Mo-1040p - Property Tax Credit/ Pension Exemption Short Form - 2012 Page 6

ADVERTISEMENT

65

o

, b

,

l

2 — s

I

l

7 — t

F

oR

ldER

lInd

InE

tAtE

nComE

InE

Ax

Rom

100 P

d

,

t

R

F

R

ERCEnt

IsAblEd

Ax

EFund

EdERAl

EtuRn

n

-

s

on

oblIgAtEd

PousE

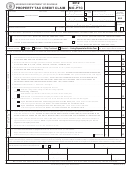

Subtract any state income tax refund

Use the chart below to locate your tax

included in your federal adjusted gross

on your federal return. Do not enter

If you or your spouse were 65 or

income (Federal Form 1040, Line 10).

your federal income tax withheld as

older or blind and qualified for these

Attach a copy of your federal return

shown on your Forms W-2 or federal

deductions on your 2012 federal

(pages 1 and 2).

return.

return, check the appropriate boxes.

If you have an earned income credit,

l

5 — I

You may check the 100 percent disabled

InE

nComE

you must subtract the credit from the

box if you are unable to engage in any

P

ERCEntAgEs

tax on your federal return. If a negative

substantial gainful activity by reason of

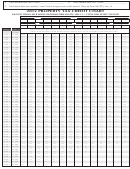

Complete the chart below if both

amount is calculated, enter “0”. If you

any medically de terminable physical or

spouses have income:

used a method other than the federal

mental impairment that can be expected

tax table to determine your federal tax,

to result in death or has lasted, or can be

Yourself

attach the appropriate schedule.

expected to last, for a continuous period

Line 3Y_____________ divided by

Line 4 ___________= ___________

of not less than 12 months.

FEDERAL

FORM

LINE NUMBERS

Spouse

You may check the non-obligated

1040

Line 55 minus Lines 45,

Line 3S_____________ divided by

spouse box if your spouse owes the

64a, 66, 67, and amounts

Line 4 ___________= ___________

state of Missouri any child support

from Forms 8839, 8801

payments, back taxes, student loans,

and 8885 on Line 71.*

The total entered on Line 5 must equal

etc., and you do not want your portion

100 percent — round to the nearest

1040A

Line 35 minus Lines 38a,

of the refund used to pay the amounts

40, and any alternative

whole number. Note: If one spouse has

owed by your spouse. Debts owed

minimum tax included on

negative income and the other spouse

to the Internal Revenue Service (IRS)

Line 28.

has positive income (Example: your

are excluded from the non-obligated

1040EZ

Line 10 minus Line 8a.

income is -$15,000 and your spouse’s

spouse apportionment. The De part-

income is $30,000), enter 0 percent on

1040X

Line 8 minus Lines 13 and

ment of Revenue cannot apportion the

14, except amounts from

Line 5Y and 100 percent on Line 5S.

Property Tax Credit.

Forms 2439 and 4136.

l

6 — F

s

InE

IlIng

tAtus And

l

1 — F

A

InE

EdERAl

djustEd

*Note: At the time the Department

E

A

xEmPtIon

mount

g

I

Ross

nComE

printed their tax booklets, the Internal

Enter on Line 6 the amount of exemp-

Revenue Service had not finalized

If your filing status is “married fil-

tion claimed for your filing status.

where Form 8839 would be reported

ing com bined,” and both spouses are

You must use the same filing status as

on the federal return. If Form 8839 is

reporting income, use the Worksheet

on your Federal Form 1040 with two

not reported on line 71 of Federal Form

on page 8 to split your income be tween

exceptions:

1040, do not reduce line 55 by the

you and your spouse. The com bined

1. Box B must be checked if you are

amount from Form 8839.

income for you and your spouse must

claimed as a dependent on another

equal the total federal adjusted gross

l

8 — s

person’s federal tax return and you

InE

tAndARd oR

income reported on your federal return.

checked either box on Federal Form

I

d

tEmIzEd

EduCtIon

Splitting the income reduces the rate

1040EZ, Line 5; or you were not

Standard Deductions: If you claimed the

at which your com bined incomes are

allowed to check Box 6a on Federal

standard deduction on your federal return,

taxed and allows you to claim non-

Forms 1040 or 1040A. If you checked

enter the standard deduction amount for

Box B, enter “0”.

obligated spouse so you will not be

your filing status. The amounts are listed

2. Box E may be checked only if all of

held responsible for your spouse’s

on Form MO-1040P, Line 8.

the following apply: a) you checked

debts to Missouri.

Use the chart below to determine

Box 3 (married filing separate return) on

For all other filing statuses, use the

your standard deduction if you or

your Federal Form 1040 or 1040A; b)

chart below.

your spouse marked any of the boxes

your spouse had no income and is not

for: 65 or older, blind, or claimed as a

required to file a federal return; and c)

FEDERAL FORM

LINE NUMBERS

dependent.

your spouse was claimed as an exemp-

1040

Line 37

tion on your federal return and was not

FEDERAL FORM

LINE NUMBERS

1040A

Line 21

a dependent of someone else. Attach a

1040

Line 40

copy of your federal return. Only one

1040EZ

Line 4

box may be checked on Line 6, Boxes A

1040A

Line 24

1040X

Line 1

through G.

1040EZ

*See following note

1040X

Line 2

6

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30 31

31 32

32