Instructions For Form Mo-1040p - Property Tax Credit/ Pension Exemption Short Form - 2012 Page 7

ADVERTISEMENT

*Note: If you filed a Federal Form

Attach a copy of your federal return

earnings taxes, or another state’s

1040EZ, and checked one or both

withholding. Attach a copy of all

(pages 1 and 2) and all Forms 1099,

boxes on Line 5, refer to the Federal

Forms W-2 and 1099. See Form W-2

1099-R, and W-2P.

Standard Deduction Worksheet for

Diagram on page 14.

l

11 — l

-t

C

Dependents.

If you did not check

InE

ong

ERm

ARE

l

19 — E

InE

stImAtEd

either box on Federal Form 1040EZ,

I

d

nsuRAnCE

EduCtIon

t

P

Ax

AymEnts

Line 5, enter $5,950 if single or

If you paid premiums for qualified

$11,900 if married.

Include any estimated tax payments

long-term care insurance in 2012,

Itemized Deductions: If you itemized

made during 2012 and any overpay-

you may be eligible for a deduction

on your federal return, you may want

ment applied from your 2011 Missouri

on your Missouri income tax return.

to itemize on your Missouri return or

return.

Qualified long-term care insurance is

take the standard deduction, which-

defined as insurance coverage for a

l

20 — P

InE

RoPERty

ever results in a higher deduction. If

period of at least 12 months for long-

t

C

you were required to itemize on your

Ax

REdIt

term care expenses should such care

federal return, you must itemize on

Complete Form MO-PTS to determine

become necessary because of a

your Missouri return. To figure your

the amount of your property tax credit.

chronic health condition or physical

itemized deductions, complete page

See Information to Complete Form

dis ability, including cognitive impair-

Attach a copy of your

18 or 22.

MO-PTS on pages 11-14.

ment or the loss of functional capacity,

federal return (pages 1 and 2) and

thus rendering an individual unable to

Federal Schedule A.

l

23 — A

InE

PPly

care for themselves without the help of

l

9 — d

o

n

InE

EPEndEnts

vERPAymEnt to

Ext

another person. Complete the work-

y

’

t

sheet below only if you paid premiums

Do not include yourself or your

EAR

s

AxEs

for a qualified long-term care in sur-

spouse as dependents.

You may apply any portion of your

ance policy and the policy is for at

Multiply the total number of depen-

refund to next year’s taxes.

least 12 months coverage.

dents you claimed on your federal

l

24 — t

F

InE

Rust

unds

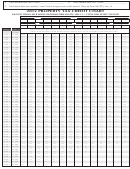

return by $1,200. Only include de-

l

16 — m

t

InE

IssouRI

Ax

pen dents claimed on Federal Forms

You may donate part or all of

If your Missouri taxable income is less

1040A or 1040, Line 6c.

your overpaid amount or contribute

than $9,000, use the tax table on page

Attach a copy of your federal return

additional payments to any of the trust

18 or 22 to determine your tax. If your

(pages 1 and 2).

funds listed on Form MO-1040P and

Missouri taxable income is more than

any two additional funds.

$9,000, follow the example below the

l

10 — P

InE

EnsIon And

tax table to calculate the tax.

Additional Funds: If you choose to give

s

s

/s

oCIAl

ECuRIty

oCIAl

to any of the additional funds, enter

A separate tax must be computed for

s

d

/

ECuRIty

IsAbIlIty

the two-digit code (see next page) in

you and your spouse.

m

E

IlItARy

xEmPtIon

the spaces provided on Line 24. If

l

18 — m

InE

IssouRI

you want to give to more than two

If you or your spouse received a

W

additional funds, please sub mit a

IthholdIng

public, private, or military pension,

contribution directly to the fund. See

social security or social security

Include only Missouri withholding as

disability, complete page 17 or 21 to

shown on your Forms W-2, 1099, or

see how much of your pension may

for additional information.

1099-R. Do not include withhold-

be tax free.

ing for federal taxes, local taxes, city

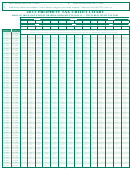

Worksheet for Long-Term Care Insurance Deduction

A. Enter the amount paid for qualified long-term care insurance policy. ......................................... A) $_____________

If you itemized on your federal return and your federal itemized deductions

included medical expenses, go to Line B. If not, skip to H.

B. Enter the amount from Federal Schedule A, Line 4. ..................................................................... B) $_____________

C. Enter the amount from Federal Schedule A, Line 1. .................................................................... C) $_____________

D. Enter the amount of qualified long-term care included on Line C. .............................................. D) $_____________

E. Subtract Line D from Line C. ........................................................................................................ E) $_____________

F. Subtract Line E from Line B. If amount is less than zero, enter “0”. ............................................ F) $_____________

G. Subtract Line F from Line A. ........................................................................................................ G) $_____________

H. Enter Line G (or Line A if you did not have to complete

Lines B through G) on Form MO-1040P, Line 11

Attach a copy of your Federal Form 1040 (pages 1 and 2) and Federal Schedule A (if you itemized your deductions).

7

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30 31

31 32

32