Instructions For Form Mo-1040p - Property Tax Credit/ Pension Exemption Short Form - 2012 Page 17

ADVERTISEMENT

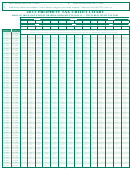

PENSION AND SOCIAL SECURITY/SOCIAL SECURITY DISABILITY/MILITARY EXEMPTION

PUBLIC PENSION CALCULATION

Pensions received from any federal, state, or local government.

—

1

00

1. Missouri adjusted gross income from Form MO-1040P, Line 4. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2

00

2. Taxable social security benefits from Federal Form 1040A, Line 14b or Federal Form 1040, Line 20b. . . . . . . . . . . . . . .

3

00

3. Subtract Line 2 from Line 1.. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4. Select the appropriate filing status and enter amount on Line 4. Married filing combined - $100,000; Single, Head of

4

00

Household, Married Filing Separate, and Qualifying Widow - $85,000.. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5

00

5. Subtract Line 4 from Line 3 and enter on Line 5. If Line 4 is greater than Line 3, enter $0. . . . . . . . . . . . . . . . . . . . . . . . .

S - SPOUSE

Y - YOURSELF

6. Taxable pension for each spouse from public sources from Federal Form 1040A, Line 12b or 1040, Line 16b. . . . . . . . .

6Y

00 6S

00

7. Multiply Line 6 by 100%. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7Y

00 7S

00

8. Amount from Line 7 or $35,234 (maximum social security benefit), whichever is less. . . . . . . . . . . . . . . . . . . . . . . . . . . . .

8Y

00 8S

00

9. Amount from Line 6 or $6,000, whichever is less. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

9Y

00 9S

00

10Y

00 10S

00

1 0. Amount from Line 8 or Line 9, whichever is greater. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1 1. If you received taxable social security complete Lines 1 through 8 of Section C and enter the amount(s) from Line(s)

11Y

00 11S

00

6Y and 6S. See instructions if Line 3 of Section C is more than $0... . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1 2. Subtract Line 11 from Line 10. If Line 11 is greater than Line 10, enter $0. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

12Y

00 12S

00

13

00

1 3. Add amounts on Lines 12Y and 12S.. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1 4. Total public pension, subtract Line 5, from Line 13. If Line 5 is greater than Line 13, enter $0. . . . . . . . . . . . . . . . . . . .

14

00

PRIVATE PENSION CALCULATION

Annuities, pensions, IRA’S, and 401(k) plans funded by a private source.

—

1. Missouri adjusted gross income from Form MO-1040P, Line 4.. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1

00

2. Taxable social security benefits from Federal Form 1040A, Line 14b or Federal Form 1040, Line 20b.. . . . . . . . . . . . . .

2

00

3. Subtract Line 2 from Line 1. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3

00

4. S elect the appropriate filing status and enter the amount on Line 4: Married filing combined: $32,000; Single,

4

00

Head of Household and Qualifying Widower: $25,000; Married Filing Separate: $16,000. . . . . . . . . . . . . . . . . . .

5. Subtract Line 4 from Line 3. If Line 4 is greater than Line 3, enter $0. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5

00

Y - YOURSELF

S - SPOUSE

6. Taxable pension for each spouse from private sources from Federal Form 1040A, Lines 11b and 12b, or Federal

6Y

00 6S

00

Form 1040, Lines 15b and 16b. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7Y

00 7S

00

7. Amounts from Line 6Y and 6S or $6,000, whichever is less. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

8. Add Lines 7Y and 7S. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

8

00

9. Total private pension, subtract Line 5 from Line 8. If Line 5 is greater than Line 8, enter $0. . . . . . . . . . . . . . . . . . . . .

9

00

SOCIAL SECURITY OR SOCIAL SECURITY DISABILITY CALCULATION

— To be eligible for social security deduction you must be 62 years of age

by December 31 and have marked the 62 and older box on Form MO-1040P. Age limit does not apply to social security disability deduction.

1

00

1. Missouri adjusted gross income from Form MO-1040P, Line 4.. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2. Select the appropriate filing status and enter the amount on Line 2. Married filing combined - $100,000

Single, Head of Household, Married Filing Separate, and Qualifying Widower - $85,000. . . . . . . . . . . . . . . . . . . . . .

2

00

3

00

3. Subtract Line 2 from Line 1 and enter on Line 3. If Line 2 is greater than Line 1, enter $0.. . . . . . . . . . . . . . . . . . . . . . . .

Y - YOURSELF

S - SPOUSE

4. Taxable social security benefits for each spouse from Federal Form 1040A, Line 14b or Federal Form 1040, Line 20b. . . .

4Y

00 4S

00

5 . Taxable social security disability benefits for each spouse from Federal Form 1040A, Line 14b or 1040, Line 20b. . . . . . . . . .

5Y

00 5S

00

6 . Multiply Line 4 or Line 5 by 100%. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6Y

00 6S

00

7. Add Lines 6Y and 6S. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7

00

8. Total social security/social security disability, subtract Line 3 from Line 7. If Line 3 is greater than Line 7, enter $0. . . . .

8

00

MILITARY PENSION CALCULATION

1. Military retirement benefits included on Federal Form 1040A, Line 12b or Federal Form 1040, Line 16b. . . . . . . . . . . . .

1

00

2. Taxable public pension from Federal Form 1040A, Line 12b or Federal Form 1040, Line 16b. . . . . . . . . . . . . . . . . . . . .

2

00

3. Divide Line 1 by Line 2 (Round to whole number).. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3

%

4. Multiply Line 3 by Line 14 of Section A. If you are not claiming a public pension exemption, enter $0. . . . . . . . . . . . . . .

4

00

5 . Subtract Line 4 from Line 1. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5

00

6 . Total military pension, multiply Line 5 by 45%. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6

00

TOTAL PENSION AND SOCIAL SECURITY/SOCIAL SECURITY DISABILITY/MILITARY EXEMPTION

MIL

Add Line 14 (Section A), Line 9 (Section B), Line 8 (Section C), and Line 6 (Section D).

TOTAL

Enter total amount here and on Form MO-1040P, Line 10.. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

EXEMPTION

00

MO-1040P (12-2012)

17

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

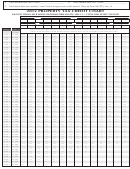

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30 31

31 32

32