Instructions For Form Mo-1040p - Property Tax Credit/ Pension Exemption Short Form - 2012 Page 9

ADVERTISEMENT

s

R

If you owe a penalty you cannot file a

a copy of your federal return (pages 1

Ign

EtuRn

Form MO-1040P. You must file a Form

and 2), your Forms 1099-R, and SSA-

You must sign Form MO-1040P, both

MO-1040 and attach Form MO-2210.

1099. Failure to provide this infor-

spouses must sign if you are filing a

mation will result in your exemption

Payments must be postmarked by April

combined return. If you use a paid

being disallowed.

15, 2013, to avoid interest and late

pre parer, the preparer must also sign

pay ment charges. The Department of

P

P

C

the return.

ublIC

EnsIon

AlCulAtIon

Rev e nue offers several payment options.

If you wish to authorize the Director

Public pensions are pensions received

Check or money order: Attach a check

of Revenue or delegate, to release in-

from any federal, state, or local gov-

or money order (U.S. funds only), pay-

formation regarding your tax account

ernment. If you have questions about

able to Missouri Department of Rev enue.

to your preparer or any member of the

whether your pension is a public or a

By submitting payment by check, you

preparer’s firm, indicate by check ing

private pension, contact your pension

authorize the Department of Revenue to

the “yes” box above the signature line.

administrator.

process the check electronically upon

A

ttAChmEnts

receipt. Do not postdate. The De part-

l

1 — m

A

InE

IssouRI

djustEd

ment of Revenue may electronically

• All Forms W-2 and 1099

g

I

Ross

nComE

resubmit checks returned for in suf fi cient

• Copy of federal return, pages 1 and

or uncollected funds.

2 and Federal Schedule A

Include your Missouri adjusted gross

— if you itemized your deductions

income from Form MO-1040P, Line 4.

If you mail your payment after your

on Line 8, Missouri Itemized

return is filed, attach your payment to

l

2 — t

s

InE

AxAblE

oCIAl

Deductions

the Form MO-1040V found on page 28.

s

b

— if you have an entry on Line

ECuRIty

EnEFIts

Electronic Bank Draft (E-Check): By

11, Long-term Care Insurance

entering your bank routing number,

Include the taxable 2012 social security

De duc tion

checking account number, and your

benefits for each spouse. This informa-

• A copy of paid Property Tax

next check number, you may pay

tion can be found on:

Re ceipt(s), rent receipts, or signed

on line at

• Federal Form 1040A—Line 14b

state ment from your landlord if you

individual/, or by calling (888) 929-

• Federal Form 1040—Line 20b

claimed the Property Tax Credit on

0513. There will be a $.60 handling

l

6 — t

P

Line 20

InE

AxAblE

ublIC

fee per filing period/transaction to use

• Documentation (a copy of Form

P

this service.

EnsIon

SSA-1099, letter from Social Se curity

Credit Card: The Department

Include the taxable 2012 public pension

Ad min is tra tion, letter from De part-

accepts MasterCard, Dis cover,

for each spouse. This information can

ment of Veterans Affairs) of the ap-

Visa, and American Express.

be found on:

plicable qualification under which

You may pay online at

• Federal Form 1040A— Line 12b

you are filing the Form MO-PTS

personal/individual/, or by calling (888)

• Federal Form 1040—Line 16b

• Federal Form 1310 and a copy

929-0513. The convenience fees listed

Do not include any payments from

of death certificate if filing for a

below will be charged to your account

private pensions, social security ben-

de ceased individual

for pro cessing credit card payments:*

efits or railroad retirement payments

m

F

mo-1040P,

AIl

oRm

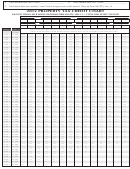

Amount of

Convenience

on this line. (Exception: If you are 100

A

,

P

Tax Paid

Fee

percent disabled, you may consider

ttAChmEnts

And

AymEnt

(

)

:

railroad retirement as taxable public

$0.00–$33.00

$1.00

IF nECEssARy

to

pension).

$33.01–$100.00

3.00%

Refund or no amount due —

$100.01–$250.00

2.95%

l

11 — s

s

Department of Revenue,

InE

oCIAl

ECuRIty

$250.01–$500.00

2.85%

P.O. Box 2800, Jefferson City, MO

s

s

oR

oCIAl

ECuRIty

$500.01–$750.00

2.85%

65105-2800

d

E

$750.01–$1,000.00

2.80%

IsAbIlIty

xEmPtIon

Balance due —

$1,000.01–$1,500.00

2.75%

Include the amount from Lines 6Y

Department of Revenue,

$1,500.01–$2,000.00

2.70%

and 6S from page 17 or 21, Section C

P.O. Box 3395, Jefferson City, MO

$2,000.01 or more

2.60%

(social security or social security dis-

65105-3395

ability calculation), unless you are a

*Note: The convenience fees for these

2-D barcode returns, see page 2.

single individual with income greater

transactions are paid to the third party

than $85,000 or a married couple with

vendor, not to the Missouri Department

P

s

s

/

EnsIon And

oCIAl

ECuRIty

income greater than $100,000. For

of Revenue. By accessing this payment

s

s

d

/

oCIAl

ECuRIty

IsAbIlIty

single individuals with income greater

system, the user will be leaving Mis-

m

E

IlItARy

xEmPtIon

than $85,000 enter the amount from

souri’s web site and connecting to the

Line 8 of Section C. For married couples

If you are claiming a pension, social

web site of the third party vendor which

security, social security disability or

with income greater than $100,000,

is a secure and confidential web site.

multiply Line 8 by the percentages on

military exemption, you must attach

9

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30 31

31 32

32