Form Dr-504ha - Ad Valorem Tax Exemption Application And Return Homes For The Aged Page 2

ADVERTISEMENT

INSTRUCTIONS

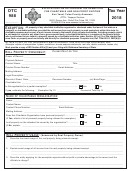

DR-504HA

R. 11/01

In addition to the general requirements specified in this application, in order for a rental unit or apartment to

qualify as exempt under s. 196.1975(4), F.S., the following classes of persons must have a gross income of

not more than that provided in s. 196.1975, F.S.

1. Persons that are age 62 years of age or older

2. Persons that are totally and permanently disabled

3. Couples, one of whom must be 62 years old or older

4. Couples, one or both of whom are totally and permanently disabled

ATTACHMENTS

You must attach the following information.

1. A copy of the applicant's corporate acknowledgment letter from the Secretary of State

2. A copy of the applicant's current non-profit Uniform Business Report (UBR) filed with the Secretary of State

3. A copy of the applicant's 501(c)(3) designation letter from the Internal Revenue Service

4. If the applicant is licensed as a nursing facility or assisted living facility, a copy of its license from the

Agency for Health Care Administration

WHERE TO FILE: The application must be filed with the county property appraiser in the respective county

where the property is located.

Application must be filed each year on or before March 1.

WHEN TO FILE:

ATTACHMENTS: Every attachment must show the name and address of the organization, the date, an

identifiable heading, and that it is an attachment to Form DR-504HA.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2