Form Rev-331a As - Authorization Agreement For Electronic Tax Payments Page 2

ADVERTISEMENT

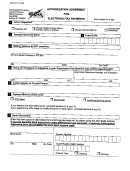

Tax:

9

Check the appropriate block(s) to indicate the tax(es) you will be paying by EFT. Enter the account number for each tax type.

If you select the ACH debit option, the tax type(s) checked should fall under the bank account listed in Section 8 from which

the payment(s) will be drawn.

File (Box) Number

1.

Capital Stock/Foreign Franchise Tax

Loans Tax

(All 3 taxes reported on RCT-101)

–

Corporate Net Income Tax

File (Box) Number

2.

Utilities Gross Receipts Tax

–

File (Box) Number

3.

Gross Receipts Telecommunication Taxes for

–

Intrastate, Interstate, Mobile

File (Box) Number

4.

Public Utility Realty Tax

–

File (Box) Number

5.

Bank Shares Tax

Title Insurance and Trust Company Shares Tax

–

Bank Loans Tax

File (Box) Number

6.

Mutual Thrift Institutions Tax

–

File (Box) Number

7.

Insurance Premiums Tax

–

File (Box) Number

8.

Marine Insurance Premiums Tax

–

EIN

9.

Liquid Fuels and Fuels Tax

–

Account Number

10.

Motor Carriers Road Tax

–

Account Number

11.

IFTA - Motor Carriers

–

Account Number

12.

Malt Beverage Tax

Account Number

13.

Cigarette Stamp Agents

Account Number

14.

Pari-Mutuel

License Number

15.

Unstampable Little Cigar Tax

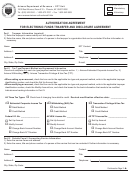

Authorized Signature Information:

10

I certify the information provided on this form is true and correct and authorize the PA Department of Revenue to use the

information herein in direct conjunction with the EFT program.

Print Name: Last

First

M.I.

Title

Date

Signature

Telephone Number

(

)

Make a copy of this completed Authorization Agreement for your records. You may fax your completed Authorization Agreement

to 717-787-0145, or mail it to the PA DEPARTMENT OF REVENUE, PO BOX 280908, HARRISBURG, PA 17128-0908.

For additional information on electronic filing visit or call 717-783-6277. Services for taxpayers

with special hearing and/or speaking needs: 1-800-447-3020 (TT only).

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2