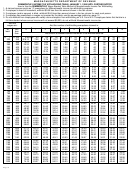

Massachusetts Circular M - Income Tax Withholding Tables January - 1999 And Thereafter Page 10

ADVERTISEMENT

MASSACHUSETTS DEPARTMENT OF REVENUE

DAILY INCOME TAX WITHHOLDING TABLE, JANUARY 1, 1999 UNTIL FURTHER NOTICE

How to Use the DAILY Wage–Bracket Table Method of Massachusetts Income Tax Withholding

1. A claimed spouse counts as “4” exemptions for Massachusetts income tax withholding purposes.

2. If employee is head of household, withhold $0.39 less than the amount shown in the tax column.

3. If employee (and/or spouse) is blind, withhold $0.36 less than amount shown in the tax column for each such person.

4. If employee has exemptions or wages not covered by the table, use the percentage method on page 12.

5. If employee has a miscellaneous payroll period, divide total wages by total days according to federal rules.

6. Do not withhold from employees who validly claim exemption from withholding on U.S. Form W-4. If employee claims that he/she is a

full-time student whose annual income will not exceed $8,000, do not withhold Massachusetts income tax.

And the

And the number of withholding exemptions claimed is:

wages are:

At

But

0

1

2

3

4

5

6

7

8

9

10

least

less

than

The amount of Massachusetts income tax to be withheld shall be:

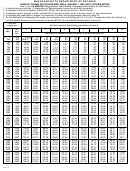

$241$

$422$

5.95%

$4.00

$4.00

$4.00

$4.00

$4.00

$4.00

$4.00

$4.00

$4.00

$4.00

022

024

1.26

.55

.38

.22

.06

.00

.00

.00

.00

.00

.00

024

026

1.37

.66

.49

.33

.17

.00

.00

.00

.00

.00

.00

026

028

1.48

.77

.60

.44

.28

.11

.00

.00

.00

.00

.00

028

030

1.59

.88

.71

.55

.39

.22

.06

.00

.00

.00

.00

030

032

1.70

.99

.82

.66

.50

.33

.17

.01

.00

.00

.00

032

034

1.81

1.10

.93

.77

.61

.44

.28

.12

.00

.00

.00

034

036

1.92

1.21

1.04

.88

.72

.55

.39

.23

.06

.00

.00

036

038

2.03

1.32

1.15

.99

.83

.66

.50

.34

.17

.01

.00

038

040

2.14

1.43

1.26

1.10

.94

.77

.61

.45

.28

.12

.00

040

042

2.25

1.54

1.37

1.21

1.05

.88

.72

.56

.39

.23

.07

042

044

2.36

1.65

1.48

1.32

1.16

.99

.83

.67

.50

.34

.18

044

046

2.47

1.76

1.59

1.43

1.27

1.10

.94

.78

.61

.45

.29

046

048

2.58

1.87

1.70

1.54

1.38

1.21

1.05

.89

.72

.56

.40

048

050

2.69

1.98

1.81

1.65

1.49

1.32

1.16

1.00

.83

.67

.51

050

052

2.80

2.09

1.92

1.76

1.60

1.43

1.27

1.11

.94

.78

.62

052

054

2.91

2.19

2.03

1.87

1.71

1.54

1.38

1.22

1.05

.89

.73

054

056

3.02

2.30

2.14

1.98

1.82

1.65

1.49

1.33

1.16

1.00

.84

056

058

3.13

2.41

2.25

2.09

1.93

1.76

1.60

1.44

1.27

1.11

.95

058

060

3.24

2.52

2.36

2.20

2.04

1.87

1.71

1.55

1.38

1.22

1.06

060

062

3.35

2.63

2.47

2.31

2.15

1.98

1.82

1.66

1.49

1.33

1.17

062

064

3.46

2.74

2.58

2.42

2.26

2.09

1.93

1.77

1.60

1.44

1.28

064

066

3.57

2.85

2.69

2.53

2.37

2.20

2.04

1.88

1.71

1.55

1.39

066

068

3.68

2.96

2.80

2.64

2.48

2.31

2.15

1.99

1.82

1.66

1.50

068

070

3.79

3.07

2.91

2.75

2.59

2.42

2.26

2.10

1.93

1.77

1.61

070

072

3.90

3.18

3.02

2.86

2.70

2.53

2.37

2.21

2.04

1.88

1.72

072

074

4.02

3.30

3.14

2.97

2.81

2.65

2.49

2.32

2.16

2.00

1.83

074

076

4.14

3.42

3.26

3.09

2.93

2.77

2.60

2.44

2.28

2.12

1.95

076

078

4.26

3.54

3.38

3.21

3.05

2.89

2.72

2.56

2.40

2.23

2.07

078

080

4.37

3.66

3.49

3.33

3.17

3.01

2.84

2.68

2.52

2.35

2.19

080

082

4.49

3.78

3.61

3.45

3.29

3.12

2.96

2.80

2.64

2.47

2.31

082

084

4.61

3.90

3.73

3.57

3.41

3.24

3.08

2.92

2.75

2.59

2.43

084

086

4.73

4.01

3.85

3.69

3.53

3.36

3.20

3.04

2.87

2.71

2.55

086

088

4.85

4.13

3.97

3.81

3.64

3.48

3.32

3.16

2.99

2.83

2.67

088

090

4.97

4.25

4.09

3.93

3.76

3.60

3.44

3.27

3.11

2.95

2.79

090

092

5.09

4.37

4.21

4.05

3.88

3.72

3.56

3.39

3.23

3.07

2.90

092

094

5.21

4.49

4.33

4.16

4.00

3.84

3.68

3.51

3.35

3.19

3.02

094

096

5.33

4.61

4.45

4.28

4.12

3.96

3.79

3.63

3.47

3.31

3.14

096

098

5.45

4.73

4.57

4.40

4.24

4.08

3.91

3.75

3.59

3.42

3.26

098

100

5.56

4.85

4.68

4.52

4.36

4.20

4.03

3.87

3.71

3.54

3.38

100

102

5.68

4.97

4.80

4.64

4.48

4.31

4.15

3.99

3.83

3.66

3.50

102

104

5.80

5.09

4.92

4.76

4.60

4.43

4.27

4.11

3.94

3.78

3.62

104

106

5.92

5.20

5.04

4.88

4.72

4.55

4.39

4.23

4.06

3.90

3.74

106

108

6.04

5.32

5.16

5.00

4.83

4.67

4.51

4.35

4.18

4.02

3.86

108

110

6.16

5.44

5.28

5.12

4.95

4.79

4.63

4.46

4.30

4.14

3.98

110

112

6.28

5.56

5.40

5.24

5.07

4.91

4.75

4.58

4.42

4.26

4.09

112

114

6.40

5.68

5.52

5.35

5.19

5.03

4.87

4.70

4.54

4.38

4.21

114

116

6.52

5.80

5.64

5.47

5.31

5.15

4.98

4.82

4.66

4.50

4.33

116

118

6.64

5.92

5.76

5.59

5.43

5.27

5.10

4.94

4.78

4.61

4.45

118

120

6.75

6.04

5.87

5.71

5.55

5.39

5.22

5.06

4.90

4.73

4.57

120

122

6.87

6.16

5.99

5.83

5.67

5.50

5.34

5.18

5.02

4.85

4.69

122

124

6.99

6.28

6.11

5.95

5.79

5.62

5.46

5.30

5.13

4.97

4.81

Page 10

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16