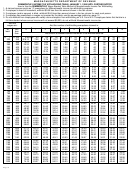

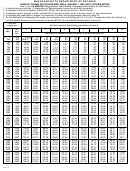

Massachusetts Circular M - Income Tax Withholding Tables January - 1999 And Thereafter Page 14

ADVERTISEMENT

Forms & Publications

Where to get forms and publications

Form Number Title/ Fax Code

To obtain Massachusetts forms and publications by phone, call the

1-ES

Estimated Income Tax Vouchers/ 306

Department’s main information lines at (617) 887-MDOR or toll-free in

Instructions for Completing Form 1-ES/ 809

Massachusetts at 1-800-392-6089. Please note that many forms and

Application for Abatement/ 326

CA-6

publications are available 24 hours a day by calling the Department’s

automated forms request system at the numbers listed above.

M-2848

Power of Attorney and Declaration of

Representative/ 348

Many Massachusetts tax forms and publications also are available via

Instructions for Completing Form M-2848/ 848

DOR’s website at

M-4

Massachusetts Employee’s Withholding

Copies of many forms and publications are also available through

Exemption Certificate and Instructions/ 366

DOR’s Fax on Demand system. Call (617) 887-1900 using the key-

M-4P

Massachusetts Withholding Exemption

pad and the handset on your fax machine, and enter the code num-

Certificate for Pension, Annuity and Other

ber following the title of the appropriate document.

Periodic and Nonperiodic Payments and

Publication Title/

Fax Code

Instructions/ 367

A Guide to the Department of Revenue: Your Taxpayer Bill of

M-941

Employer’s Quarterly Return of Income Taxes

Rights/3005 (22 pages)

Withheld and Instructions

A Guide to Filing Your Massachusetts Income Taxes/3010

M-941A

Employer’s Annual Return of Income Taxes

Should You Be Paying Estimated Taxes?/3008 (4 pages)

Withheld and Instructions

A Guide to Withholding of Taxes on Wages/3007 (14 pages)

M-941-AM

Amended Return of Income Taxes Withheld and

Instructions/ 338

A Guide to Sales and Use Tax/3009 (18 pages)

M-941D

Quarterly Return of Income Taxes Withheld for

A Guide to Sales Tax on Meals/3012 (14 pages)

Employer Paying Weekly and Instructions

A Guide to Estate Taxes (Applicable to dates of death prior to

M-941W

Employer’s Weekly Payment of Income Taxes

January 1, 1997)/3011 (14 pages)

Withheld and Instructions

A Guide to Estate Taxes (Applicable to dates of death on or after

M-942

Employer’s Monthly Return of Income Taxes

January 1, 1997)/3013 (10 pages)

Withheld and Instructions

Small Business Packet contains registration materials, tax information,

TA-1

Massachusetts Trustee Tax Application for

sample forms and information from other state agencies, and is avail-

Original Registration/ 314

able by calling DOR’s Customer Service Bureau at (617) 887-6100.

Instructions for Completing Form TA-1/ 814

Taxpayer Advisory Bulletin is published quarterly with updates on

TA-2

Application for Additional Registration/ 315

legislative, legal and Departmental decisions and is available at

Instructions for Completing Form TA-2/ 814

most libraries or by calling DOR’s Publishing Services Office at

TA-3, TA-4

Supporting Schedules for Forms TA-1 and/or

(617) 626-2800.*

TA-2/ 1383

MASSTAX Guide contains five volumes covering all state taxes and

Trustee Taxes

General Information/ 816

DOR administrative procedures; it is available for purchase through

WH-PEN

Massachusetts Income Tax Withholding

the West Group (1-800-328-9352) or for reference at many law li-

from Taxable Pension, Annuity and Other

braries and at the State House Library.

Periodic Payments and from Nonperiodic

DOR Regulations , Technical Information Releases (TIRs) , Directives

Payments/ 373

and Rulings are prepared on general tax issues as well as specific

WHPM

Massachusetts Income Tax Withholding System

taxpayer inquiries and are published in the MASSTAX Guide or are

Percentage Methods for Wages Paid from

available by calling DOR’s Rulings and Regulations Bureau at

January 1, 1999 Until Further Notice/ 374

(617) 626-3250.*

Employer’s Quarterly Report of Wages Paid/ 317

WR-1

Instructions for Completing Form WR-1/ 817

*To receive copies by Fax on Demand please call (617) 887-1900 for a complete menu.

Wage Reporting Magnetic Media Transmitter

Report/ 318

Instructions for Filing on Magnetic Media/ 818

WR-2

Continuation Sheet for Employer’s Quarterly

Report of Wages Paid/ 319

Page 14

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16