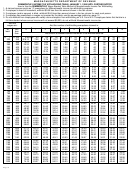

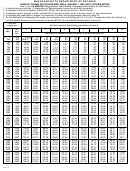

Massachusetts Circular M - Income Tax Withholding Tables January - 1999 And Thereafter Page 12

ADVERTISEMENT

Rev. 7/98

Massachusetts Income Tax Withholding System

Massachusetts

Percentage Methods for Wages Paid from

Department of

January 1999 Until Further Notice

Revenue

From employee’s total wages:

1. Subtract the amount deducted for the U.S. Social Security (FICA),

total from the wages: Weekly, $46; Biweekly, $92; Semimonthly,

Medicare, Massachusetts, United States or Railroad Retirement sys-

$100; Monthly, $200; Daily $6.50; Annually, $2,400;

tems. The total amount subtracted may not exceed $2,000. When,

or (b) subtract the head of household tax value from the step 3 re-

during the year, the total amount subtracted reaches the equivalent

sult: Weekly, $2.75; Biweekly, $5.49; Semimonthly, $5.95; Monthly,

of the $2,000 maximum allowable as a deduction by Massachu-

$11.90; Daily, $0.39; Annually, $142.80.

setts, discontinue this step.

5. If the employee and/or his/her spouse is blind: either (a) add the

2. Subtract the total of the exemption factors, i.e., the dollar value of

blind exemption factor to the other exemption factors in steps 2

the employee’s exemptions, for the applicable payroll period. If an

and 4(a), if applicable, before subtracting the total from the wages:

employee claims “0” exemptions, discontinue this step.

Weekly, $42.50; Biweekly, $85; Semimonthly, $92; Monthly, $183;

A claimed spouse counts as “4” exemptions for Massachusetts in-

Daily, $6; Annually, $2,200;

come tax withholding purposes. Example: an employee who claims

or (b) subtract the blindness tax value amount from the result from

only himself and his wife is treated as having “5” exemptions.

steps 3 and 4(b), if applicable: Weekly, $2.52; Biweekly, $5.03; Semi-

3. After subtracting the amounts specified in steps 1 and 2 above

monthly, $5.45; Monthly, $10.91; Daily, $0.36; Annually, $130.90.

from the employee’s total wages, multiply the difference by .0595

Important Note:

and withhold the resulting amount.

Do not withhold from employees who claim one or more exemp-

4. If the employee will file as head of household on their tax return,

tions if their wages are less than: $154 Weekly; $308 Biweekly; $334

either (a) add to the amount computed in step 2 and subtract the

Semimonthly; $667 Monthly; $22 Daily; or $8,000 Annually.

Exemption Factors:

Payroll Period

Claiming “1”

Claiming More Than “1” Exemption

a. Weekly. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

$4,484.50

$4,419.50 . . . . . multiplied by number claimed, plus . . . . . . . $4,465

b. Biweekly . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $4,169

$4,439 . . . . . . . multiplied by number claimed, plus . . . . . . . $4,130

c. Semimonthly . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $4,183

$4,442 . . . . . . . multiplied by number claimed, plus . . . . . . . $4,141

d. Monthly . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $4,367

$4,483 . . . . . . . multiplied by number claimed, plus . . . . . . . $4,284

e. Daily . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $4,412

$4,443 . . . . . . . multiplied by number claimed, plus . . . . . . . $4,449

f. Annually. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $4,400

$1,000 . . . . . . . multiplied by number claimed, plus . . . . . . . $3,400

Page 12

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16