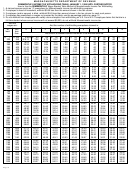

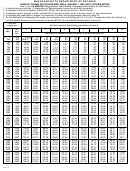

Massachusetts Circular M - Income Tax Withholding Tables January - 1999 And Thereafter Page 13

ADVERTISEMENT

Massachusetts Income Tax Withholding System

Percentage Methods for Pension, Annuity, Other

Rev. 7/98

Periodic Payments and Nonperiodic Payments

Massachusetts

(e.g., Lump-Sum Distributions)

Department of

Paid in 1999 and Thereafter Until Further Notice

Revenue

A. Payers and plan administrators of pension, annuity, other periodic

From recipient’s total payment:

payments and nonperiodic payments made to recipients with Mass-

1. Subtract the total of the exemption factors for the applicable

achusetts addresses who have not elected to be exempt from the

payroll period. A claimed spouse counts as “4” exemptions for

U.S. income tax withholding provisions must withhold Massachu-

Massachusetts income tax withholding purposes. Example: a recip-

setts income taxes, effective January 1, 1984. The Massachusetts

ient who claims only himself and his wife is treated as having “5”

withholding system differs from the U.S. system.

exemptions. If “0” exemptions claimed or if no Form M-4P, omit this

step.

B. Form M-4P

The Massachusetts Withholding Exemption Certificate, Form M-4P

a. Monthly —

(or a reproduction or other payer-substitute form), should be made

$83 multiplied by number of exemptions claimed, plus $284.

available to each recipient.

b. Quarterly —

A recipient, whether receiving periodic or nonperiodic payments, may

$250 multiplied by number of exemptions claimed, plus $850.

claim the applicable personal, age 65 or over and blind exemptions

c. Semiannually —

(for both spouses) and the exemptions for dependents. If a recipient

$500 multiplied by number of exemptions claimed, plus $1,700.

does not file Form M-4P with the payer, Massachusetts withholding

will be based on “0” exemptions. In such cases, 5.95% of each pay-

d. Annually —

ment will be withheld beginning January 1, 1992 until further notice.

$1,000 multiplied by number of exemptions claimed, plus

$3,400.

Form M-4P may be used to request that an additional amount be

withheld.

2. If the recipient will file as head of household on their tax return,

add to the amount computed in step 1 and subtract the total from

Form M-4P should also be used to claim exemption from Massachu-

the payment: Monthly, $200; Quarterly, $600; Semiannually, $1,200;

setts income tax withholding by a recipient with a Massachusetts

Annually, $2,400.

address but who is domiciled (legal resident) elsewhere and whose

pension is from certain pension plans not subject to tax under Title 4

3. If the recipient and/or spouse is blind, for each blind person add

of the United States Code, section 114.

to the amount computed in steps 1 and 2, if applicable and subtract

the total from the payment: Monthly, $183; Quarterly, $550; Semi-

Recipients with other than Massachusetts addresses may re-

annually, $1,100; Annually, $2,200.

quest, by filing Form M-4P, withholding on payments taxable by

Massachusetts.

4. After subtracting the amounts specified in steps 1, 2 and/or 3

from the recipient’s total payment, multiply the difference by .0595

C. Figuring Withholding

and withhold the resulting amount.

The Massachusetts Income Tax Withholding System Percentage

Methods for Pensions, etc., for computing amounts to withhold, ap-

Important Note:

pears in the next column. If a payment period differs from the four

Payers are requested to urge recipients to ask that additional

specified, adapt accordingly.

amounts be withheld on Form M-4P to cover taxes for certain pay-

ments taxable at the 12% rate or for other income not subject to the

D. Paying Over Amounts Withheld

withholding system.

If you are already withholding Massachusetts income taxes, include

amounts withheld from pensions, etc., along with amounts withheld

from wages. Pay over using the same returns and frequency as re-

quired by your current Massachusetts payment method.

If you are not registered as an employer under Massachusetts in-

come tax withholding law, obtain and file Form TA-1, Application for

Registration, and follow subsequent instructions.

E. Reporting to Recipients

Provide a copy of U.S. Form 1099-R — showing the total payment

and amount withheld for Massachusetts during the year — to each

recipient by the end of the next January for the Massachusetts in-

come tax return.

F. Other

Massachusetts provisions for payer and authorized sender responsi-

bilities and recordkeeping are the same as those for the U.S.

Page 13

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16