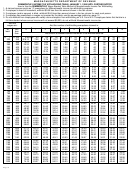

Massachusetts Circular M - Income Tax Withholding Tables January - 1999 And Thereafter Page 11

ADVERTISEMENT

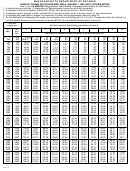

Massachusetts DAILY payroll period, January 1, 1999 until further notice — Continued

If the payroll period with respect to an employee is DAILY

And the

And the number of withholding exemptions claimed is:

wages are:

At

But

0

1

2

3

4

5

6

7

8

9

10

least

less

than

The amount of Massachusetts income tax to be withheld shall be:

$124$

$126$

$07.11

$06.39

$06.23

$06.07

$05.91

$05.74

$05.58

$05.42

$05.25

$05.09

$04.93

126

128

7.23

6.51

6.35

6.19

6.02

5.86

5.70

5.54

5.37

5.21

5.05

128

130

7.35

6.63

6.47

6.31

6.14

5.98

5.82

5.65

5.49

5.33

5.17

130

132

7.47

6.75

6.59

6.43

6.26

6.10

5.94

5.77

5.61

5.45

5.28

132

134

7.59

6.87

6.71

6.54

6.38

6.22

6.06

5.89

5.73

5.57

5.40

134

136

7.71

6.99

6.83

6.66

6.50

6.34

6.17

6.01

5.85

5.69

5.52

136

138

7.83

7.11

6.95

6.78

6.62

6.46

6.29

6.13

5.97

5.80

5.64

138

140

7.94

7.23

7.06

6.90

6.74

6.58

6.41

6.25

6.09

5.92

5.76

140

142

8.06

7.35

7.18

7.02

6.86

6.69

6.53

6.37

6.21

6.04

5.88

142

144

8.18

7.47

7.30

7.14

6.98

6.81

6.65

6.49

6.32

6.16

6.00

144

146

8.30

7.58

7.42

7.26

7.10

6.93

6.77

6.61

6.44

6.28

6.12

146

148

8.42

7.70

7.54

7.38

7.21

7.05

6.89

6.73

6.56

6.40

6.24

148

150

8.54

7.82

7.66

7.50

7.33

7.17

7.01

6.84

6.68

6.52

6.36

150

152

8.66

7.94

7.78

7.62

7.45

7.29

7.13

6.96

6.80

6.64

6.47

152

154

8.78

8.06

7.90

7.73

7.57

7.41

7.25

7.08

6.92

6.76

6.59

154

156

8.90

8.18

8.02

7.85

7.69

7.53

7.36

7.20

7.04

6.88

6.71

156

158

9.02

8.30

8.14

7.97

7.81

7.65

7.48

7.32

7.16

6.99

6.83

158

160

9.13

8.42

8.25

8.09

7.93

7.77

7.60

7.44

7.28

7.11

6.95

160

162

9.25

8.54

8.37

8.21

8.05

7.88

7.72

7.56

7.40

7.23

7.07

162

164

9.37

8.66

8.49

8.33

8.17

8.00

7.84

7.68

7.51

7.35

7.19

164

166

9.49

8.77

8.61

8.45

8.29

8.12

7.96

7.80

7.63

7.47

7.31

166

168

9.61

8.89

8.73

8.57

8.40

8.24

8.08

7.92

7.75

7.59

7.43

168

170

9.73

9.01

8.85

8.69

8.52

8.36

8.20

8.03

7.87

7.71

7.55

170

172

9.85

9.13

8.97

8.81

8.64

8.48

8.32

8.15

7.99

7.83

7.66

172

174

9.97

9.25

9.09

8.92

8.76

8.60

8.44

8.27

8.11

7.95

7.78

174

176

10.09

9.37

9.21

9.04

8.88

8.72

8.55

8.39

8.23

8.07

7.90

176

178

10.21

9.49

9.33

9.16

9.00

8.84

8.67

8.51

8.35

8.18

8.02

178

180

10.32

9.61

9.44

9.28

9.12

8.96

8.79

8.63

8.47

8.30

8.14

180

182

10.44

9.73

9.56

9.40

9.24

9.07

8.91

8.75

8.59

8.42

8.26

182

184

10.56

9.85

9.68

9.52

9.36

9.19

9.03

8.87

8.70

8.54

8.38

184

186

10.68

9.96

9.80

9.64

9.48

9.31

9.15

8.99

8.82

8.66

8.50

186

188

10.80

10.08

9.92

9.76

9.59

9.43

9.27

9.11

8.94

8.78

8.62

188

190

10.92

10.20

10.04

9.88

9.71

9.55

9.39

9.22

9.06

8.90

8.74

190

192

11.04

10.32

10.16

10.00

9.83

9.67

9.51

9.34

9.18

9.02

8.85

192

194

11.16

10.44

10.28

10.11

9.95

9.79

9.63

9.46

9.30

9.14

8.97

194

196

11.28

10.56

10.40

10.23

10.07

9.91

9.74

9.58

9.42

9.26

9.09

196

198

11.40

10.68

10.52

10.35

10.19

10.03

9.86

9.70

9.54

9.37

9.21

198

200

11.51

10.80

10.63

10.47

10.31

10.15

9.98

9.82

9.66

9.49

9.33

200

202

11.63

10.92

10.75

10.59

10.43

10.26

10.10

9.94

9.78

9.61

9.45

202

204

11.75

11.04

10.87

10.71

10.55

10.38

10.22

10.06

9.89

9.73

9.57

204

206

11.87

11.15

10.99

10.83

10.67

10.50

10.34

10.18

10.01

9.85

9.69

206

208

11.99

11.27

11.11

10.95

10.78

10.62

10.46

10.30

10.13

9.97

9.81

208

210

12.11

11.39

11.23

11.07

10.90

10.74

10.58

10.41

10.25

10.09

9.93

210

212

12.23

11.51

11.35

11.19

11.02

10.86

10.70

10.53

10.37

10.21

10.04

212

214

12.35

11.63

11.47

11.30

11.14

10.98

10.82

10.65

10.49

10.33

10.16

214

216

12.47

11.75

11.59

11.42

11.26

11.10

10.93

10.77

10.61

10.45

10.28

216

218

12.59

11.87

11.71

11.54

11.38

11.22

11.05

10.89

10.73

10.56

10.40

218

220

12.70

11.99

11.82

11.66

11.50

11.34

11.17

11.01

10.85

10.68

10.52

220

222

12.82

12.11

11.94

11.78

11.62

11.45

11.29

11.13

10.97

10.80

10.64

222

224

12.94

12.23

12.06

11.90

11.74

11.57

11.41

11.25

11.08

10.92

10.76

224

226

13.06

12.34

12.18

12.02

11.86

11.69

11.53

11.37

11.20

11.04

10.88

Page 11

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16