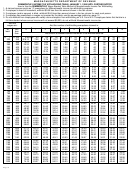

Massachusetts Circular M - Income Tax Withholding Tables January - 1999 And Thereafter Page 2

ADVERTISEMENT

MASSACHUSETTS DEPARTMENT OF REVENUE

WEEKLY INCOME TAX WITHHOLDING TABLE, JANUARY 1, 1999 UNTIL FURTHER NOTICE

How to Use the WEEKLY Wage–Bracket Table Method of Massachusetts Income Tax Withholding

1. A claimed spouse counts as “4” exemptions for Massachusetts income tax withholding purposes.

2. If employee is head of household, withhold $2.75 less than the amount shown in the tax column.

3. If employee (and/or spouse) is blind, withhold $2.52 less than amount shown in the tax column for each such person.

4. If employee has exemptions or wages not covered by the table, use the percentage method on page 12.

5. Do not withhold from employees who validly claim exemption from withholding on U.S. Form W-4. If employee claims that he/she is a

full-time student whose annual income will not exceed $8,000, do not withhold Massachusetts income tax.

And the

And the number of withholding exemptions claimed is:

wages are:

At

But

0

1

2

3

4

5

6

7

8

9

10

least

less

than

The amount of Massachusetts income tax to be withheld shall be:

$151$

$150$

5.95%

$10.00

$10.00

$10.00

$10.00

$10.00

$10.00

$10.00

$10.00

$10.00

$10.00

150

160

$18.52

3.48

2.34

1.19

.05

.00

.00

.00

.00

.00

.00

160

170

9.07

4.03

2.89

1.74

.60

.00

.00

.00

.00

.00

.00

170

180

9.62

4.58

3.44

2.29

1.15

.00

.00

.00

.00

.00

.00

180

190

10.17

5.13

3.99

2.84

1.70

.55

.00

.00

.00

.00

.00

190

200

10.71

5.68

4.54

3.39

2.25

1.10

.00

.00

.00

.00

.00

200

210

11.26

6.23

5.09

3.94

2.80

1.65

.51

.00

.00

.00

.00

210

220

11.81

6.78

5.64

4.49

3.35

2.20

1.06

.00

.00

.00

.00

220

230

12.36

7.33

6.18

5.04

3.90

2.75

1.61

.46

.00

.00

.00

230

240

12.91

7.88

6.73

5.59

4.45

3.30

2.16

1.01

.00

.00

.00

240

250

13.46

8.43

7.28

6.14

5.00

3.85

2.71

1.56

.42

.00

.00

250

260

14.01

8.98

7.83

6.69

5.54

4.40

3.26

2.11

.97

.00

.00

260

270

14.56

9.53

8.38

7.24

6.09

4.95

3.81

2.66

1.52

.37

.00

270

280

15.11

10.08

8.93

7.79

6.64

5.50

4.35

3.21

2.07

.92

.00

280

290

15.66

10.63

9.48

8.34

7.19

6.05

4.90

3.76

2.62

1.47

.33

290

300

16.21

11.18

10.03

8.89

7.74

6.60

5.45

4.31

3.17

2.02

.88

300

310

16.76

11.72

10.58

9.44

8.29

7.15

6.00

4.86

3.71

2.57

1.43

310

320

17.31

12.27

11.13

9.99

8.84

7.70

6.55

5.41

4.26

3.12

1.98

320

330

17.86

12.82

11.68

10.54

9.39

8.25

7.10

5.96

4.81

3.67

2.53

330

340

18.41

13.37

12.23

11.08

9.94

8.80

7.65

6.51

5.36

4.22

3.07

340

350

18.96

13.92

12.78

11.63

10.49

9.35

8.20

7.06

5.91

4.77

3.62

350

360

19.51

14.47

13.33

12.18

11.04

9.90

8.75

7.61

6.46

5.32

4.17

360

370

20.06

15.02

13.88

12.73

11.59

10.44

9.30

8.16

7.01

5.87

4.72

370

380

20.61

15.57

14.43

13.28

12.14

10.99

9.85

8.71

7.56

6.42

5.27

380

390

21.16

16.12

14.98

13.83

12.69

11.54

10.40

9.26

8.11

6.97

5.82

390

400

21.70

16.67

15.53

14.38

13.24

12.09

10.95

9.80

8.66

7.52

6.37

400

410

22.25

17.22

16.08

14.93

13.79

12.64

11.50

10.35

9.21

8.07

6.92

410

420

22.80

17.77

16.62

15.48

14.34

13.19

12.05

10.90

9.76

8.62

7.47

420

430

23.35

18.32

17.17

16.03

14.89

13.74

12.60

11.45

10.31

9.16

8.02

430

440

23.90

18.87

17.72

16.58

15.44

14.29

13.15

12.00

10.86

9.71

8.57

440

450

24.45

19.42

18.27

17.13

15.98

14.84

13.70

12.55

11.41

10.26

9.12

450

460

25.00

19.97

18.82

17.68

16.53

15.39

14.25

13.10

11.96

10.81

9.67

460

470

25.55

20.52

19.37

18.23

17.08

15.94

14.80

13.65

12.51

11.36

10.22

470

480

26.10

21.07

19.92

18.78

17.63

16.49

15.34

14.20

13.06

11.91

10.77

480

490

26.65

21.62

20.47

19.33

18.18

17.04

15.89

14.75

13.61

12.46

11.32

490

500

27.20

22.16

21.02

19.88

18.73

17.59

16.44

15.30

14.16

13.01

11.87

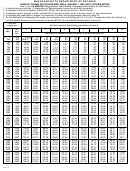

500

510

27.76

22.72

21.58

20.44

19.29

18.15

17.00

15.86

14.71

13.57

12.43

510

520

28.35

23.32

22.18

21.03

19.89

18.74

17.60

16.45

15.31

14.17

13.02

520

530

28.95

23.91

22.77

21.63

20.48

19.34

18.19

17.05

15.90

14.76

13.62

530

540

29.54

24.51

23.37

22.22

21.08

19.93

18.79

17.64

16.50

15.36

14.21

540

550

30.14

25.10

23.96

22.82

21.67

20.53

19.38

18.24

17.09

15.95

14.81

550

560

30.73

25.70

24.56

23.41

22.27

21.12

19.98

18.83

17.69

16.55

15.40

560

570

31.33

26.29

25.15

24.01

22.86

21.72

20.57

19.43

18.28

17.14

16.00

570

580

31.92

26.89

25.75

24.60

23.46

22.31

21.17

20.02

18.88

17.74

16.59

580

590

32.52

27.48

26.34

25.20

24.05

22.91

21.76

20.62

19.47

18.33

17.19

590

600

33.11

28.08

26.94

25.79

24.65

23.50

22.36

21.21

20.07

18.93

17.78

600

610

33.71

28.67

27.53

26.39

25.24

24.10

22.95

21.81

20.66

19.52

18.38

610

620

34.30

29.27

28.13

26.98

25.84

24.69

23.55

22.40

21.26

20.12

18.97

620

630

34.90

29.86

28.72

27.58

26.43

25.29

24.14

23.00

21.85

20.71

19.57

630

640

35.49

30.46

29.32

28.17

27.03

25.88

24.74

23.59

22.45

21.31

20.16

640

650

36.09

31.05

29.91

28.77

27.62

26.48

25.33

24.19

23.04

21.90

20.76

650

660

36.68

31.65

30.51

29.36

28.22

27.07

25.93

24.78

23.64

22.50

21.35

Page 2

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16