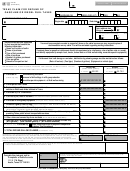

FORM M-36

PAGE 2

(REV. 2013)

SCHEDULE OF TAX RATES

SCHEDULE I. GASOLINE AND DIESEL OIL

APPLICABLE

TYPE OF

CITY & COUNTY

COUNTY

COUNTY

COUNTY

TAX

FUEL

OF HONOLULU

OF MAUI

OF HAWAII

OF KAUAI

Gasoline

16¢

16¢

16¢

16¢

State

Diesel Oil

15¢

15¢

15¢

15¢

a

Gasoline

16.5¢

16¢

8.8¢

13¢/15¢

County

a

Diesel Oil

16.5¢

16¢

8.8¢

13¢/15¢

a

Gasoline

32.5¢

32¢

24.8¢

29¢/31¢

Total

a

Diesel Oil

31.5¢

31¢

23.8¢

28¢/30¢

COMPUTATION OF TAX REFUND

Gasoline

Diesel Oil

1

1

State Tax

16¢ x

Gals.

= $

15¢ x

Gals.

= $

County Tax:

Honolulu

16.5¢ x

Gals. = $

16.5¢ x

Gals. = $

Maui

16¢ x

Gals. = $

16¢ x

Gals. = $

Hawaii

8.8¢ x

Gals. = $

8.8¢ x

Gals. = $

a

a

Kauai

13¢/15¢

x

Gals. = $

13¢/15¢

x

Gals. = $

Refund on Gallons Used Off Public Highways

$

$

(Enter amount(s) in the appropriate column(s) on line 8–Front Page)

SCHEDULE II. ALTERNATIVE FUEL

APPLICABLE

TYPE OF

CITY & COUNTY

COUNTY

COUNTY

COUNTY

TAX

FUEL

OF HONOLULU

OF MAUI

OF HAWAII

OF KAUAI

Biodiesel

4¢

4¢

4¢

4¢

State

Compressed Natural Gas

0.8¢

0.8¢

0.8¢

0.8¢

Ethanol

2.4¢

2.4¢

2.4¢

2.4¢

Liquefied Natural Gas

2.4¢

2.4¢

2.4¢

2.4¢

LPG

5.2¢

5.2¢

5.2¢

5.2¢

Methanol

1.9¢

1.9¢

1.9¢

1.9¢

Biodiesel

8.3¢

0¢

0¢

0¢

County

a

Compressed Natural Gas

1.3¢

1.2¢

0.7¢

1¢/1.1¢

a

Ethanol

2.4¢

3.8¢

1.3¢

1.9¢/2.2¢

a

Liquefied Natural Gas

4.7¢

4.5¢

2.5¢

3.7¢/4.2¢

a

LPG

5.4¢

4.3¢

2.9¢

4.3¢/5¢

a

Methanol

1.8¢

2.9¢

1¢

1.4¢/1.7¢

Biodiesel

12.3¢

4¢

4¢

4¢

Total

a

Compressed Natural Gas

2.1¢

2¢

1.5¢

1.8¢/1.9¢

a

Ethanol

4.8¢

6.2¢

3.7¢

4.3¢/4.6¢

a

Liquefied Natural Gas

7.1¢

6.9¢

4.9¢

6.1¢/6.6¢

a

LPG

10.6¢

9.5¢

8.1¢

9.5¢/10.2¢

a

Methanol

3.7¢

4.8¢

2.9¢

3.3¢/3.6¢

COMPUTATION OF TAX REFUND

Note: If you are requesting a refund for more than one type of alternative fuel, attach a separate schedule showing the type of alternative fuel, tax rate,

number of gallons, and total refund claimed.

Type of Alternative Fuel

1

State Tax

(Tax rate from Schedule II) x

Gals.

= $

County Tax:

Honolulu

(Tax rate from Schedule II) x

Gals. = $

Maui

(Tax rate from Schedule II) x

Gals. = $

Hawaii

(Tax rate from Schedule II) x

Gals. = $

Kauai

(Tax rate from Schedule II) x

Gals. = $

Refund on Gallons Used Off Public Highways

$

(Enter amount in the alternative fuel column on line 8–Front Page)

1

Same as Line 4, front page

a

Effective July 1, 2013, pursuant to Kauai County Resolution No. 2013-47, Draft 3.

FORM M-36

1

1 2

2