Instructions For Form Ct-1120 - Connecticut Corporation Business Tax - 2012 Page 14

ADVERTISEMENT

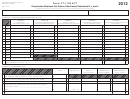

Line 2 - Enter the beginning (Column A) and ending

Line 7 - Enter in Column B any corporate tax imposed

on or measured by income or profits by any state (other

(Column B) values of paid-in or capital surplus, including

retained earnings. Any deficit must be reported as a

than Connecticut) or political subdivision, or the District

negative number. See federal Form 1120, Schedule L,

of Columbia, deducted in the computation of federal

Lines 23, 24, and 25.

taxable income.

Line 8 - Add the amounts on Line 6 and Line 7 in

Line 3 - Enter the beginning (Column A) and ending

(Column B) values of all surplus reserves. Attach a

Column B. Enter the total here and on Schedule D,

Line 3.

schedule of all surplus reserves to support the amounts

shown on Line 3.

Schedule G - Additional Required

A reserve is an amount set aside or deducted from current

or retained earnings for meeting future liabilities.

Information

Line 4 - Add Lines 1, 2, and 3 in both Column A

Attach a schedule of corporate officers’ names, complete

and Column B. Enter in Column C the average of

home addresses, and corporate titles.

Column A and Column B.

Line 1 - Enter the Connecticut towns in which the

Line 5 - Enter the total holdings of stock in Column A

corporation owns or leases, as lessee, real or tangible

and Column B. Enter in Column C the average of

personal property or performed any services.

Column A and Column B.

Line 2(a) - If the corporation transferred a controlling

Attach a schedule that lists the beginning and ending book

interest in an entity where the entity owns, directly

values of total holdings of stock of private corporations,

or indirectly, an interest in Connecticut real property,

including treasury stock. The total book value of shares

the corporation (the transferor) may be subject to the

must equal the amount claimed as a deduction on

controlling interest transfer tax. Enter the name and

Schedule E, Line 5. The book value of stock does not

FEIN of the entity in which a controlling interest

include the value of other assets acquired and held in

was transferred. The transferor is required to file

connection with or incidental to the ownership of such

Form AU-330, Controlling Interest Transfer Taxes.

stock.

Line 2(b) - If this corporation owned Connecticut real

Private corporations means all non-governmental

property and was the entity in which a direct or indirect

corporations, whether closely or publicly held.

controlling interest was transferred, enter the name and

Line 6 - Subtract Line 5, Column C, from Line 4,

FEIN of the transferor. The transferor may be subject to

Column C. Enter the result here and on Form CT-1120,

the controlling interest transfer tax.

Schedule B, Line 1.

Line 2(c) -Enter the transferee(s) name(s) and the transfer

date if the answer was Yes to either Line 2(a) or Line 2(b).

Schedule F - Taxes

Attach a list of property addresses of the Connecticut

realty owner according to the above transfer.

Line 1 - Enter in Column A all payroll taxes deducted in

The entity in which a direct or indirect controlling

arriving at federal taxable income.

i n t e r e s t w a s t r a n s f e r r e d i s r e q u i r e d t o f i l e

Line 2 - Enter in Column A all real property taxes

Form AU-331, Controlling Interest Transfer Taxes

deducted in arriving at federal taxable income.

Informational Return.

Line 3 - Enter in Column A all personal property taxes

Line 3 - If any other corporation owns a majority of the

deducted in arriving at federal taxable income.

voting stock of this corporation, enter the name and FEIN

Line 4 - Enter in Column A all sales and use taxes

of the corporation.

deducted in arriving at federal taxable income.

Line 4 - Enter the last taxable year this corporation was

Line 5 - Enter in Column A any other taxes not based on

audited by the IRS. Corrections to taxable income by the

income or profits deducted in arriving at federal taxable

IRS must be reported to the Commissioner of Revenue

income.

Services on or before 90 days after the final determination

Line 6 - Enter in Column B the amount of Connecticut

of the change.

corporation business tax deducted in arriving at federal

All federal adjustments must be reported using

taxable income.

Form CT-1120X for separate or unitary filers, or an

amended Form CT-1120CR for combined filers.

Page 14

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16