Instructions For Form Ct-1120 - Connecticut Corporation Business Tax - 2012 Page 2

ADVERTISEMENT

What This Booklet Contains

If the corporation already has a Connecticut Tax

Registration Number, additional taxes for which the

Read the information contained in this booklet carefully

corporation is liable may be added to the registration by

before preparing the Connecticut corporation business

contacting the DRS Registration Unit at 860-297-4885.

tax return.

Business Entity Tax: The business entity tax (BET) is

This booklet contains information and instructions about

an annual tax of $250 imposed on the following business

the following forms:

types:

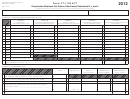

Form CT-1120, Corporation Business Tax Return, is

• S corporations (Qualified subchapter S subsidiaries

used to compute tax both on a net income basis and on

(QSSS) are not liable for the BET.);

a capital stock basis. Tax is paid on the basis that yields

• Limited liability companies (LLCs or SMLLCs) that

the higher tax. The minimum tax is $250.

are, for federal income tax purposes, either:

Form CT-1120 ATT, Corporation Business Tax

• Treated as a partnership, if it has two or more

Return Attachment, contains the following computation

members; or

schedules:

• Disregarded as an entity separate from its owner,

Schedule H, Connecticut Apportioned Operating

if it has a single member;

Loss Carryover;

• Limited liability partnerships (LLPs); and

Schedule I, Dividend Deduction; and

• Limited partnerships (LPs).

Schedule J, Bonus Depreciation Recovery.

The BET applies to those business entities listed above

Form CT-1120A, Corporation Business Tax Return

if either: 1) the entities were formed under Connecticut

Apportionment Computation, is used to compute the

law; or 2) the entities were not formed under Connecticut

apportionment factors for the net income and the

law but are required to register with or obtain a certificate

minimum tax base.

of authority from the Connecticut Secretary of the State

Form CT-1120K, Business Tax Credit Summary, is used

before transacting business in the state (regardless of

to summarize a corporation’s claim for available business

whether or not the entities have complied with the

tax credits.

requirement). Visit the DRS website at

for additional information regarding the BET.

Form CT-1120 EXT, Application for Extension of Time

to File Corporation Business Tax Return, is submitted to

Connecticut Sales and Use Taxes: A corporation

obtain an extension of time to file Form CT-1120

may be responsible for the filing of sales and use tax

returns. Sales taxes are due if the company sells taxable

Form CT-1120AB, Summary of Add Back and Exceptions

goods or services. Use taxes are due on the purchase of

to Add Back of Interest and Intangible Expenses, is used

taxable goods or services from out-of-state retailers or

to add back otherwise deductible interest expenses and

Connecticut retailers who have failed to collect the sales

costs and intangible expenses and costs paid to a related

tax. Both taxes are reported on Form OS-114, Sales and

member, and must be completed by each corporation that

Use Tax Return.

pays interest or intangible expenses to a related party.

Visit

the

Department of Revenue Services (DRS) website

Connecticut Income Tax Withholding: Any corporation

at to download and print Connecticut

that maintains an office or transacts business in

tax forms and publications.

Connecticut and that is considered an employer for

federal income tax withholding purposes must withhold

Other Taxes for Which the Corporation May

Connecticut income tax from wages and certain other

payments to employees, whether or not the payroll

be Liable

department is located in Connecticut.

The information that follows is intended to be a general

description of other Connecticut taxes for which a

Controlling Interest Transfer Tax: Connecticut imposes

corporation may be liable. Failure to pay these or any

a tax on the transfer of a controlling interest in an entity

taxes for which the corporation is liable may subject

where the entity owns, directly or indirectly, an interest in

the corporation and its officers to civil and criminal

Connecticut real property. This tax is reported on Form

penalties.

AU-330, Controlling Interest Transfer Taxes.

To register for sales and use taxes, Connecticut income

tax withholding, and most other Connecticut taxes

administered by DRS, the corporation must complete

Form REG-1, Business Taxes Registration Application.

Visit the DRS website to register online.

Page 2

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16