Instructions For Form Ct-1120 - Connecticut Corporation Business Tax - 2012 Page 7

ADVERTISEMENT

Estimated Tax Payments

Amended Returns

Every corporation subject to the Connecticut corporation

For income years beginning on or after January 1, 2006,

business tax whose estimated current year tax exceeds

any corporation, combined group or unitary group that

$1,000 must make its required annual payment in four

fails to include items of income or deduction or makes

installments.

any other error on a return must:

The required annual payment is the lesser of:

1. File an amended return using Form CT-1120X,

• 90% of the tax (including surtax) shown on the return

Amended Corporation Business Tax Return, that

applies to the tax year being amended; or

for the income year, or, if no return is filed, 90% of the

tax for such year; or

2. If the corporation was included in a combined

• 100% of the tax (including surtax) shown on the return

corporation business tax return, file an amended

for the previous income year without regard to any

combined return on Form CT-1120CR, Combined

credit, if the previous income year was an income year

Corporation Business Tax Return, that applies to the

of 12 months and if the company filed a return for the

tax year being amended and check the Amended box.

previous income year showing a liability for tax.

If a corporation or any entity included in a combined or

unitary group has filed an amended federal return with

The Department of Revenue Services (DRS) encourages

all corporations to file and pay their estimated taxes

the IRS and the amendment affects the corporation’s

electronically, and it requires any corporation that paid

Connecticut tax return, then within 90 days of the IRS

final determination on that amended federal return, the

tax in excess of $4,000 the prior year to pay the current

year liability electronically. To file and pay estimated

corporation shall file Form CT-1120X, and attach a copy

of federal Form 1120X, Amended U.S. Corporation

taxes electronically, visit the Taxpayer Service Center

(TSC) at and select Business.

Income Tax return.

Corrections to taxable income made by the IRS must be

A corporation that is not required to make estimated tax

reported to the Commissioner of Revenue Services on or

payments electronically, and does not otherwise choose

before 90 days after the final determination of the change.

to use the TSC, must use estimated tax payment coupons

All federal adjustments must be reported on an amended

Forms CT-1120 ESA, ESB, ESC, and ESD, Estimated

return. An extension request for reporting federal audit

Corporation Business Tax. Using preprinted estimated

changes may be submitted in writing to the Commissioner

tax payment coupons will ensure accuracy and timeliness

stating the reason additional time is required.

in processing the corporation’s estimated tax payments.

Visit the DRS website to download and print Connecticut

If the adjustment on a Connecticut amended return

tax forms.

is not related to an adjustment made on a federal

amended return (e.g. an adjustment to Connecticut net

If the due date falls on a Saturday, Sunday, or legal

income, Connecticut minimum tax base, a Connecticut

holiday, the next business day is the due date.

apportionment factor, a Connecticut net operating loss,

The estimated tax due dates table indicates the amount due

or a Connecticut corporation business tax credit), explain

for each installment under the regular installment method.

such adjustment in detail and attach all appropriate

For more information regarding estimated corporation

supporting forms and schedules.

business tax payments, including information regarding

the annualized installment method, see Informational

Publication 2012(10), Q & A on Estimated Corporation

Business Tax and Worksheet CT-1120AE.

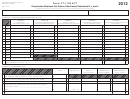

Estimated tax due dates:

Estimated Tax Due Dates

Required Payment Amounts

The estimated payments for the income year are the lesser of:

First

ESA - Fifteenth day of the third

30% of prior year tax (including surtax) without regard to credits or

month of the income year

27% of current year tax (including surtax)

Second

ESB - Fifteenth day of the sixth

*70% of prior year tax (including surtax) without regard to credits or

month of the income year

63% of current year tax (including surtax)

Third

ESC - Fifteenth day of the ninth

*80% of prior year tax (including surtax) without regard to credits or

month of the income year

72% of current year tax (including surtax)

Fourth

ESD - Fifteenth day of the twelfth

*100% of prior year tax (including surtax) without regard to credits or

month of the income year

90% of current year tax (including surtax)

*Taking into account all prior estimated tax payments made for this year.

Page 7

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16