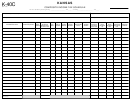

Form Rv-083 - Municipal/special Jurisdiction Tax Schedule Page 2

ADVERTISEMENT

South Dakota Dept. of Revenue - Municipal/Special Jurisdiction Tax Schedule

Reporting Period____________

License #__________________

City

Code

Net Taxable Sales

%

Column A Tax Due City

Code

Net Taxable Sales

%

Column A Tax Due

Glenham*

145-2

2.0%

- Leola*

208-2

2.0%

-

Gregory*

147-2

2.0%

- Lesterville*

209-2

2.0%

-

Gregory

147-1

1.0%

- Letcher*

210-2

2.0%

-

Grenville*

148-2

2.0%

- Letcher

210-1

1.0%

-

Groton*

149-2

2.0%

- Madison*

221-2

2.0%

-

Groton

149-1

1.0%

- Madison

221-1

1.0%

-

Harrisburg*

151-2

2.0%

- Marion*

226-2

2.0%

-

Harrisburg

151-1

1.0%

- Martin*

227-2

2.0%

-

Harrold*

153-2

2.0%

- Martin

227-1

1.0%

-

Report Under North Sioux City

Hartford*

154-2

2.0%

- McCook Lake*

Hartford

154-1

1.0%

- McIntosh*

219-2

2.0%

-

Hayti*

156-2

2.0%

- McLaughlin*

220-2

1.0%

-

Hazel*

157-2

1.0%

- Menno*

233-2

2.0%

-

Hecla*

158-2

1.0%

- Midland*

234-2

2.0%

-

Henry*

159-2

1.0%

- Milbank*

235-2

2.0%

-

Hermosa*

160-2

2.0%

- Milbank

235-1

1.0%

-

Herreid*

161-2

2.0%

- Miller*

237-2

2.0%

-

Highmore*

164-2

2.0%

- Mission*

239-2

2.0%

-

Highmore

164-1

1.0%

- Mitchell*

242-2

2.0%

-

Hill City*

165-2

2.0%

- Mitchell

242-1

1.0%

-

Hill City

165-1

1.0%

- Mobridge*

243-2

2.0%

-

Hitchcock*

166-2

1.0%

- Mobridge

243-1

1.0%

-

Hosmer*

168-2

2.0%

- Monroe*

244-2

1.0%

-

Hot Springs*

169-2

2.0%

- Montrose*

245-2

2.0%

-

Hot Springs

169-1

1.0%

- Morristown*

246-2

1.0%

-

Hoven*

171-2

2.0%

- Mound City*

247-2

2.0%

-

Howard*

172-2

2.0%

- Mount Vernon*

248-2

2.0%

-

Hudson*

174-2

2.0%

- Mount Vernon

248-1

1.0%

-

Humboldt*

175-2

2.0%

- Murdo*

250-2

2.0%

-

Humboldt

175-1

1.0%

- Murdo

250-1

1.0%

-

Hurley*

176-2

2.0%

- New Underwood*

254-2

2.0%

-

Huron*

177-2

2.0%

- Newell*

255-2

2.0%

-

Huron

177-1

1.0%

- Nisland*

256-2

2.0%

-

Interior*

179-2

1.9%

- North Sioux City*

258-2

2.0%

-

Ipswich*

181-2

2.0%

- North Sioux City

258-1

1.0%

-

Irene*

182-2

2.0%

- Oacoma*

261-2

2.0%

-

Irene

182-1

1.0%

- Oacoma

261-1

1.0%

-

Iroquois*

183-2

1.0%

- Oldham*

266-2

2.0%

-

Isabel*

184-2

2.0%

- Olivet*

267-2

1.0%

-

Java*

185-2

2.0%

- Onida*

269-2

2.0%

-

Jefferson*

186-2

2.0%

- Orient*

272-2

1.0%

-

Kadoka*

187-2

2.0%

- Parker*

276-2

2.0%

-

Kadoka

187-1

1.0%

- Parkston*

277-2

2.0%

-

Kennebec*

190-2

2.00%

- Parkston

277-1

1.0%

-

Kennebec

190-1

1.0%

- Peever*

279-2

2.0%

-

Keystone*

192-2

2.0%

- Philip*

280-2

2.0%

-

Keystone

192-1

1.0%

- Pickstown*

281-2

2.0%

-

Kimball*

193-2

2.0%

- Piedmont*

282-2

2.0%

-

Kimball

193-1

1.0%

- Pierpont

283-2

2.0%

-

Kranzburg*

194-2

2.0%

- Pierre*

284-2

2.0%

-

La Bolt*

196-2

1.0%

- Pierre

284-1

1.0%

-

Lake Andes*

197-2

2.0%

- Plankinton*

286-2

2.0%

-

Lake Norden*

199-2

1.0%

- Platte*

287-2

2.0%

-

Lake Preston*

200-2

2.0%

- Platte

287-1

1.0%

-

Langford*

202-2

2.0%

- Pollock*

288-2

2.0%

-

Lead*

204-2

2.0%

- Presho*

291-2

2.0%

-

Lead

204-1

1.0%

- Pringle*

292-2

2.0%

-

Lemmon*

206-2

2.0%

- Quinn*

295-2

1.0%

-

Lennox*

207-2

2.0%

- Quinn

295-1

1.0%

-

* Indicates the General Rate

Bold Indicates the Gross Receipts Rate

RV-083 July - December 2012

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3