PAGE 2

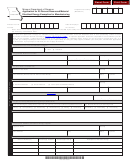

Missouri Tax Identification Number

|

|

|

|

|

|

|

Estimated

Estimated

Hours

Days

Weeks

Amp

Wattage

Wattage

Number

Hours Used

Hours Used

KWH

Description of Exempt

Volts

Phase

HP

Per Day

Per

Per

Draws

from VA

from HP

of Units

Electrical Equipment

Annually

Annually X No.

Per Year

(run-time)

Year

Week

Per Unit

of Units

EXAMPLE

Attach a detailed listing

Total KWH

Please calculate the hours used on each piece of taxable equipment for the full calendar year. The calculations in Part C

Section 144.030.2(13),

RSMo, and should not take into account

are for the purpose of calculating the exemption under

the additional exempt electricity under

Section 144.054.2,

RSMo.

Section 144.030.2(13),

RSMo, exempts from state and local sales tax “electrical energy used in the actual primary

manufacturing, processing, compounding, mining or producing of a product, or electrical energy used in the actual secondary

processing or fabricating of the product, or a material recovery processing plant as defined in subdivision (4) of this

subsection, in facilities owned or leased by the taxpayer, … if the raw materials used in such processing contain at least

twenty-five percent recovered materials as defined in

Section 260.200,

RSMo.”

Section 144.054,

RSMo, effective August 28, 2007, exempts from state sales tax “electrical energy used or consumed

in the manufacturing, processing, compounding, mining, or producing of any product or used or consumed in the

processing of recovered materials ....”

If total exempt electricity after taking into account the additional

exempt usage per

Section 144.054.2,

RSMo, is at least 76% of total usage, the electricity is 100% exempt from

state tax. Therefore, electricity that does not qualify for the state and local sales tax exemption under

Section

144.030.2(13),

RSMo, is subject to local sales tax only.

Percentage

Estimated Usage

KWH

A. Total Electricity Used (taken from suppliers bills)

A

100%

B. Taxable Electricity Used

B

(Part C Total)

(B÷A)

C. Exempt Electricity Used

C

(A–B)

(C÷A)

Final Return: If this is your final return, enter the close date below and select the reason for closing your account. The Sales Tax law

requires any person selling or discontinuing business to make a final sales tax return within fifteen (15) days of the sale or closing.

Date Business Closed: ___________________________________________

Out of Business

Sold Business

Leased Business

Complete Part E, Page 3, prior to signing the return.

If you do not qualify, it is your responsibility to notify your utility provider, withdraw your exemption, and remit the appropriate tax to the

state. Under penalties of perjury, I declare that I have direct control, supervision or responsibility for completing this return. I attest that I

have no taxable utility purchases to report for locations left blank.

If you pay by check, you authorize the Department of Revenue to process the check electronically.

Any check returned unpaid may be presented again electronically.

Sign and Date Return: This must be signed and dated by the taxpayer or by the taxpayer’s authorized agent.

Signature of Taxpayer or Agent

Print Name

Title

Date Signed (MM/DD/YYYY)

Tax Period (MMDDYYYY) Thru (MMDDYYYY)

Thru

__ __ / __ __ / __ __ __ __

__ __ / __ __ / __ __ __ __

__ __ / __ __ / __ __ __ __

Form 53-E25 (Revised 12-2013)

1

1 2

2 3

3