Worksheet Instructions (K-70)

ADVERTISEMENT

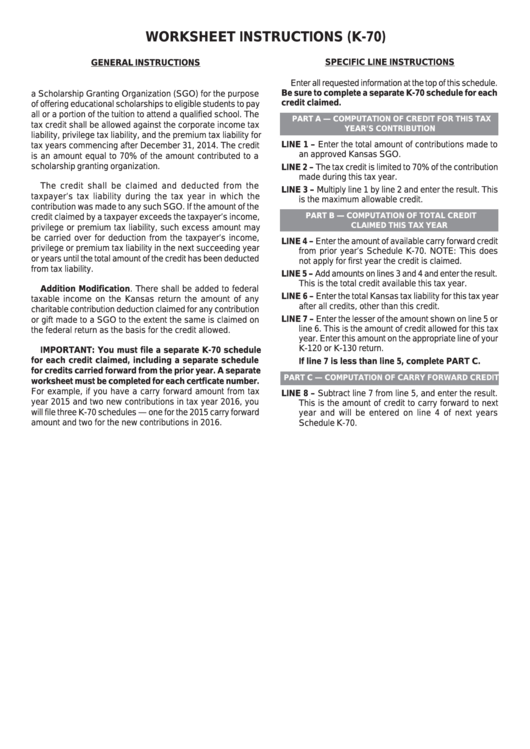

WORKSHEET INSTRUCTIONS (K-70)

SPECIFIC LINE INSTRUCTIONS

GENERAL INSTRUCTIONS

Enter all requested information at the top of this schedule.

K.S.A. 72-99a07 provides a tax credit for contributions to

Be sure to complete a separate K-70 schedule for each

a Scholarship Granting Organization (SGO) for the purpose

credit claimed.

of offering educational scholarships to eligible students to pay

all or a portion of the tuition to attend a qualified school. The

PART A — COMPUTATION OF CREDIT FOR THIS TAX

tax credit shall be allowed against the corporate income tax

YEAR’S CONTRIBUTION

liability, privilege tax liability, and the premium tax liability for

LINE 1 – Enter the total amount of contributions made to

tax years commencing after December 31, 2014. The credit

an approved Kansas SGO.

is an amount equal to 70% of the amount contributed to a

scholarship granting organization.

LINE 2 – The tax credit is limited to 70% of the contribution

made during this tax year.

The credit shall be claimed and deducted from the

LINE 3 – Multiply line 1 by line 2 and enter the result. This

taxpayer’s tax liability during the tax year in which the

is the maximum allowable credit.

contribution was made to any such SGO. If the amount of the

PART B — COMPUTATION OF TOTAL CREDIT

credit claimed by a taxpayer exceeds the taxpayer’s income,

CLAIMED THIS TAX YEAR

privilege or premium tax liability, such excess amount may

be carried over for deduction from the taxpayer’s income,

LINE 4 – Enter the amount of available carry forward credit

privilege or premium tax liability in the next succeeding year

from prior year’s Schedule K-70. NOTE: This does

or years until the total amount of the credit has been deducted

not apply for first year the credit is claimed.

from tax liability.

LINE 5 – Add amounts on lines 3 and 4 and enter the result.

This is the total credit available this tax year.

Addition Modification. There shall be added to federal

LINE 6 – Enter the total Kansas tax liability for this tax year

taxable income on the Kansas return the amount of any

after all credits, other than this credit.

charitable contribution deduction claimed for any contribution

LINE 7 – Enter the lesser of the amount shown on line 5 or

or gift made to a SGO to the extent the same is claimed on

line 6. This is the amount of credit allowed for this tax

the federal return as the basis for the credit allowed.

year. Enter this amount on the appropriate line of your

K-120 or K-130 return.

IMPORTANT: You must file a separate K-70 schedule

for each credit claimed, including a separate schedule

If line 7 is less than line 5, complete PART C.

for credits carried forward from the prior year. A separate

PART C — COMPUTATION OF CARRY FORWARD CREDIT

worksheet must be completed for each certficate number.

For example, if you have a carry forward amount from tax

LINE 8 – Subtract line 7 from line 5, and enter the result.

year 2015 and two new contributions in tax year 2016, you

This is the amount of credit to carry forward to next

will file three K-70 schedules — one for the 2015 carry forward

year and will be entered on line 4 of next years

amount and two for the new contributions in 2016.

Schedule K-70.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1