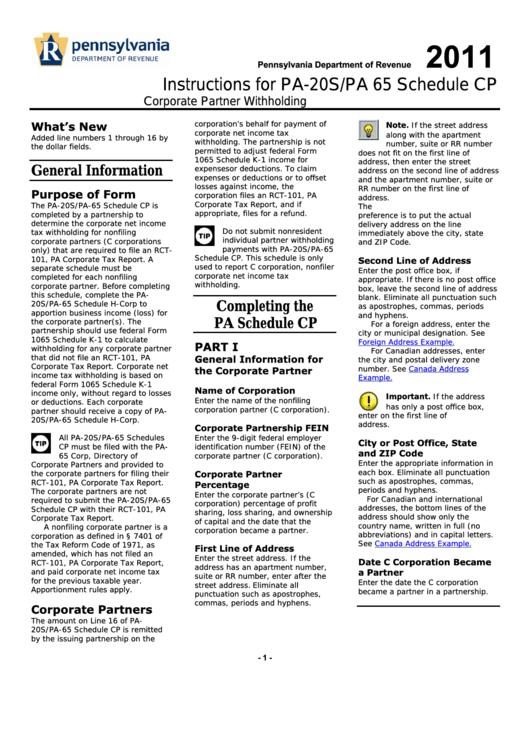

Instructions For Form Pa-20s/pa 65 - Schedule Cp - Corporate Partner Withholding - 2011

ADVERTISEMENT

2011

Pennsylvania Department of Revenue

Instructions for PA-20S/PA 65 Schedule CP

Corporate Partner Withholding

corporation’s behalf for payment of

What’s New

Note.

If the street address

corporate net income tax

along with the apartment

Added line numbers 1 through 16 by

withholding. The partnership is not

number, suite or RR number

the dollar fields.

permitted to adjust federal Form

does not fit on the first line of

1065 Schedule K-1 income for

address, then enter the street

expenses or deductions. To claim

General Information

address on the second line of address

expenses or deductions or to offset

and the apartment number, suite or

losses against income, the

RR number on the first line of

Purpose of Form

corporation files an RCT-101, PA

address.

Corporate Tax Report, and if

The PA-20S/PA-65 Schedule CP is

The U.S. Postal Service

appropriate, files for a refund.

completed by a partnership to

preference is to put the actual

determine the corporate net income

delivery address on the line

Do not submit nonresident

tax withholding for nonfiling

immediately above the city, state

individual partner withholding

corporate partners (C corporations

and ZIP Code.

payments with PA-20S/PA-65

only) that are required to file an RCT-

Schedule CP. This schedule is only

101, PA Corporate Tax Report. A

Second Line of Address

used to report C corporation, nonfiler

separate schedule must be

Enter the post office box, if

corporate net income tax

completed for each nonfiling

appropriate. If there is no post office

withholding.

corporate partner. Before completing

box, leave the second line of address

this schedule, complete the PA-

blank. Eliminate all punctuation such

20S/PA-65 Schedule H-Corp to

Completing the

as apostrophes, commas, periods

apportion business income (loss) for

and hyphens.

the corporate partner(s). The

PA Schedule CP

For a foreign address, enter the

partnership should use federal Form

city or municipal designation. See

1065 Schedule K-1 to calculate

Foreign Address Example.

PART I

withholding for any corporate partner

For Canadian addresses, enter

that did not file an RCT-101, PA

General Information for

the city and postal delivery zone

Corporate Tax Report. Corporate net

number. See

Canada Address

the Corporate Partner

income tax withholding is based on

Example.

federal Form 1065 Schedule K-1

Name of Corporation

income only, without regard to losses

Important.

If the address

Enter the name of the nonfiling

or deductions. Each corporate

has only a post office box,

corporation partner (C corporation).

partner should receive a copy of PA-

enter on the first line of

20S/PA-65 Schedule H-Corp.

address.

Corporate Partnership FEIN

All PA-20S/PA-65 Schedules

Enter the 9-digit federal employer

City or Post Office, State

CP must be filed with the PA-

identification number (FEIN) of the

and ZIP Code

65 Corp, Directory of

corporate partner (C corporation).

Enter the appropriate information in

Corporate Partners and provided to

each box. Eliminate all punctuation

the corporate partners for filing their

Corporate Partner

such as apostrophes, commas,

RCT-101, PA Corporate Tax Report.

Percentage

periods and hyphens.

The corporate partners are not

Enter the corporate partner’s (C

For Canadian and international

required to submit the PA-20S/PA-65

corporation) percentage of profit

addresses, the bottom lines of the

Schedule CP with their RCT-101, PA

sharing, loss sharing, and ownership

address should show only the

Corporate Tax Report.

of capital and the date that the

country name, written in full (no

A nonfiling corporate partner is a

corporation became a partner.

abbreviations) and in capital letters.

corporation as defined in § 7401 of

See

Canada Address Example.

the Tax Reform Code of 1971, as

First Line of Address

amended, which has not filed an

Enter the street address. If the

Date C Corporation Became

RCT-101, PA Corporate Tax Report,

address has an apartment number,

and paid corporate net income tax

a Partner

suite or RR number, enter after the

for the previous taxable year.

Enter the date the C corporation

street address. Eliminate all

Apportionment rules apply.

became a partner in a partnership.

punctuation such as apostrophes,

commas, periods and hyphens.

Corporate Partners

The amount on Line 16 of PA-

20S/PA-65 Schedule CP is remitted

by the issuing partnership on the

- 1 -

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3