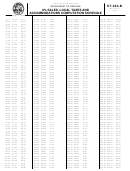

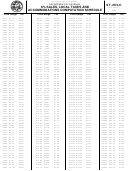

Form St-400 - Sales And Local Taxes Booklet Page 6

ADVERTISEMENT

LOOK

REVIEW

GUIDELINES FOR AVOIDING MOST COMMON

SALES TAX ERRORS AND PROCESSING DELAYS

FORMS INFORMATION

Current year forms must be used. Do not alter pre-printed file number (retail license or use tax number) or

period covered.

All submitted forms must be completed with a valid file number (retail license or use tax registration number)

and period covered.

Blank forms may be obtained by calling 1-800-768-3676, (803) 898-5320 (in Columbia) or visit our website at:

RETURN INFORMATION FOR ST-3

Use the correct return for the period ended.

A return must be filed for each period, even if no tax is due.

Complete all lines denoted with , even if the amount is zero.

Returns must be postmarked or electronically submitted with full payment on or before the 20th of the month following

the closing of the period covered.

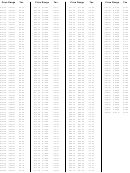

FORM INFORMATION FOR ST-389

Complete form ST-389 when deliveries and/or sales are made in any county that imposes a local county/municipality tax.

See for most current information regarding local taxes.

Enter each local tax separately on the form with the appropriate county or municipality code.

DO NOT collect or remit local taxes for counties/municipalities that DO NOT impose a local county/municipality tax.

NOTE: You must enter the codes for county/municipality in which your business is located and for which sales/deliveries

are made.

Complete form ST-389 if you make sales of unprepared foods in a county with a local tax.

NOTE: Sales of unprepared food are only exempt from a local sales and use tax if the local sales and use tax

specifically exempts such sales.

DISCOUNT INFORMATION

Taxpayer's discount is only for timely filed and fully paid returns.

Use the correct discount rate: 3% if combined state and local tax liability is less than $100

2% if combined state and local tax liability is $100 or more.

The same discount rate will also apply to the local tax(es).

Maximum discount allowed (state and local tax) is $3000 ($3100 for electronically filed returns). Any excess or

disallowed discount will be billed back to the taxpayer with penalty and interest.

See instructions for additional information relating to the maximum discount.

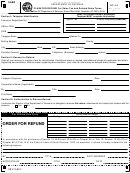

OVERPAYMENT (NEGATIVE FIGURES) INFORMATION

DO NOT claim credits (negative figures) on returns or addendums.

A refund claim must be submitted for overpayments of tax previously paid.

For additional information, refer to ST-14: Claim for Refund Section on the Essential Information page or call

(803) 898-5000.

REMITTANCE (CHECKS)

1. Checks must be made payable to: SC DEPARTMENT OF REVENUE

Your Name

Your Address

20

2. Verify the dollar and written amount of the check.

Any Town, State Zip

SAMPLE

3. Indicate type of tax, period covered and retail license number

$

2

1

on the check.

Pay to

Dollars

2

4. Sign your check.

3

4

FOR

5. Use black ink only.

123456789

123456

1234

4

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

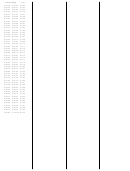

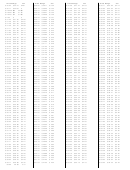

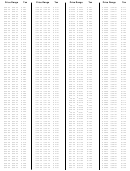

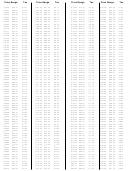

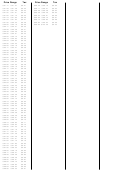

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30 31

31 32

32 33

33 34

34 35

35 36

36 37

37 38

38 39

39 40

40 41

41 42

42 43

43 44

44 45

45 46

46 47

47 48

48 49

49 50

50 51

51 52

52 53

53 54

54 55

55 56

56 57

57 58

58 59

59 60

60 61

61 62

62 63

63 64

64 65

65 66

66 67

67 68

68 69

69 70

70 71

71 72

72 73

73 74

74 75

75 76

76 77

77 78

78