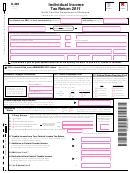

Page 2

Last Name (First 10 Characters)

Your Social Security Number

Tax Year

D-400X-WS Web-Fill

2011

10-11

When to File - File Form D-400X-WS only after you have filed your original return. Generally, to receive a refund, your amended return must

be filed within three years from the date the original return was due or within two years after the tax was paid, whichever date was later. If a

valid extension was filed, a refund claimed on an amended return may be filed within three years from the extended due date.

How to File and Pay - Attach Form D400X-WS, Worksheet for Amending Individual Tax Return, to the front of the corrected Form D-400.

Be sure to fill in the amended return indicator and complete all lines on the corrected Form D-400.

Line 12 Instructions - Enter the amount of overpayment shown on Line 26 of your original return. This amount must be considered in

preparing Form D-400X-WS because any refund you have not yet received from your original return will be sent to you separately from

any additional refund you claim on Form D-400X-WS. If your original return was changed or audited by the Department of Revenue and

as a result there was a change in the overpayment of tax, include the corrected overpayment on line 12. Do not include any interest you

received on any refund.

Line 15 Instructions - If you owe additional tax, interest is due on that amount from the due date of the original return to the date of payment. Go

to the Department of Revenue website at to determine the applicable interest rate. Include the accrued

interest in your payment.

Mail all Amended returns, payment for the amount shown due on Line 16, and Form D-400V Amended to:

N.C. DEPT. OF REVENUE, P.O. BOX 25000, RALEIGH, NC 27640-0640

Important: You must attach the corrected Form D-400 (with the amended indicator

filled in and all lines completed) to the Form D-400X-WS.

Amended Return Payment Options

Online - You can pay your tax online by bank draft or credit or debit card using Visa or MasterCard. Go to our website

and click on Electronic Services for details.

Payment Voucher - If you do not pay your tax online, use payment voucher (Form D-400V Amended). Go to our website at

https://eservices.dor.nc.gov/vouchers/d400v_amended.jsp to generate a personalized D-400V Amended payment voucher.

Complete the voucher and enclose it with your amended return and payment. Do not send cash. Write your name, address, and

SSN on your payment. Note: The Department will not accept a check, money order, or cashier’s check unless it is drawn on a U.S.

(domestic) bank and the funds are payable in U.S. dollars. Be sure to enter your social security number(s) in the boxes provided on the

voucher. Please do not staple, tape, paper clip, or otherwise attach your payment or voucher to your amended return or to each other.

Explanation of Changes

Give the reason for each change. Attach all supporting forms and schedules for the items changed. Be sure to include

your name and social security number on any attachments. If the changes are also applicable to your federal return,

include a copy of Federal Form 1040X. If there was a change to wages or State withholding, be sure to include

corrected Forms W-2 or 1099. Refunds will not be processed without a complete explanation of changes and

required attachments.

I certify that, to the best of my knowledge, this return is

If prepared by a person other than taxpayer, this certification is

accurate and complete.

based on all information of which the preparer has any knowledge.

Your Signature

Date

Paid Preparer’s Signature

Date

Spouse’s Signature (If filing joint return, both must sign.)

Date

Preparer’s FEIN, SSN, or PTIN

Daytime Telephone Number (Include area code.)

Preparer’s Telephone Number (Include area code.)

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8