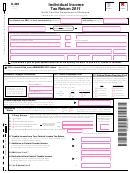

Page 2

Your Social Security Number

Last Name (First 10 Characters)

Tax Year

2011

D-400TC Web-Fill

10-11

Part 4. Other Tax Credits (Limited to the amount of tax)

(continued)

21. Credit for long-term care insurance premiums (Complete the Worksheet for Determining Tax

21.

Credit for Premiums Paid on Long-term Care Insurance Contracts on Page 18 of the instructions.)

Do not enter more than $350 per contract.

22.

22. Credit for adoption expenses (Complete the Adoption Tax Credit Worksheet on Page 18 of the instructions.)

23. Credit for children with disabilities who require special education

23.

(See instructions on Page 18.)

24. Credit for Qualified Business Investments (See instructions on Page 18. You must attach a copy of

24.

the tax credit approval letter that you received from the Department of Revenue.)

25. Credit for disabled taxpayer, dependent, or spouse (Complete Form D-429, Worksheet for

25.

Determining the Credit for the Disabled Taxpayer, Dependent, or Spouse, and

enter the amount from Line 13 or 14, whichever is applicable.)

26. Credit for certain real property land donations (See instructions on Page 19.)

26.

Enter expenditures and expenses on Lines 27a, 28a, 29a, and 30a only in the first year the credit is taken

27.

Credit for rehabilitating an income-producing historic structure (See instructions on Page 19.)

Enter installment

Enter qualified

27a.

27b.

amount of credit

rehabilitation expenditures

28.

Credit for rehabilitating a nonincome-producing historic structure (See instructions on Page 19.)

Enter installment

Enter rehabilitation

28a.

28b.

expenses

amount of credit

29.

Credit for rehabilitating an income-producing historic mill facility (See instructions on Page 19.)

Enter qualified

29a.

29b.

Enter amount of credit

rehabilitation expenditures

30.

Credit for rehabilitating a nonincome-producing historic mill facility (See instructions on Page 19.)

Enter installment

Enter rehabilitation

30a.

30b.

amount of credit

expenses

31. Other miscellaneous income tax credits (See instructions on Page 19.)

Fill in applicable circles:

Property Taxes on Farm Machinery

Gleaned Crops

Handicapped Dwelling Units

Poultry Composting

31.

Conservation Tillage Equipment

Recycling Oyster Shells

32.

32.

Tax credits carried over from previous year, if any. Do not include any

carryover of tax credits claimed on Form NC-478.

33.

33. Total (Add Lines 19, 20b, 21, 22, 23, 24, 25, 26, 27b, 28b, 29b, 30b, 31, and 32)

34.

34. Amount of total North Carolina income tax (From Form D-400, Line 14)

35. Enter the lesser of Line 33 or Line 34

35.

36. Business incentive and energy tax credits (See

Fill in circle if

instructions on Page 20. Attach Form NC-478

NC-478 is attached.

36.

and any required supporting schedules to the

Example:

front of your income tax return.)

37.

Add Lines 35 and 36 (Enter the total here and on Form D-400, Line 15.)

37.

The amount on this line may not exceed the tax shown on Form D-400, Line 14.

Part 5. Earned Income Tax Credit (Not limited to the amount of tax)

You are allowed a credit equal to 5% of the Earned Income Tax Credit allowed on your federal return. For part-year residents and nonresidents, the

credit must be prorated based on the ratio of income subject to North Carolina tax to total federal income.

38. Enter the amount of your federal earned income tax credit.

Number of qualifying children

38.

39. Multiply Line 38 by 5% (.05)

39.

Full-year residents enter this amount here and on Line 21 of Form D-400.

40. Part-year residents and nonresidents multiply the amount on Line 39 by the decimal amount from Form

D-400, Line 12 and enter the result here and on Line 21 of Form D-400. If Line 12 of Form D-400 is more

40.

than 1.0000, enter the amount from Line 39 here and on Line 21 of Form D-400.

Part 6. Tax Credit for Small Businesses That Pay N.C. Unemployment Insurance (Not limited to the amount of tax)

41. a. Enter the amount of qualified N.C. Unemployment Insurance Contributions

41a.

b. Multiply Line 41a by 25% (.25) and enter the amount here and on Line 22 of Form D-400

41b.

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8