Page 4

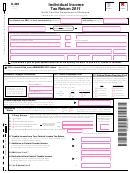

Last Name (First 10 Characters)

Your Social Security Number

Tax Year

2011

D-400 Web-Fill

10-11

Deductions from Federal Taxable Income

(

continued)

51.

Adjustment for absorbed Non-ESB NOL added back in 2003, 2004, 2005, and 2006

51.

(See instructions on Page 14)

52.

Other deductions from federal taxable income

(Attach explanation or schedule.

52.

Do not include any deduction for retirement benefits on this line.)

53.

Total deductions - Add Lines 42 through 52

53.

(Enter the total here and on Line 9)

Computation of North Carolina Taxable Income for Part-Year Residents and Nonresidents

(See Line Instructions beginning on Page 14. Note: Do not complete Lines 54 through 56 if you were a full-year resident.)

Fill in applicable circles

You

Spouse

Fill in circle(s) if you or your spouse moved into or out of North Carolina during the year and enter the dates of residency in the boxes.

You

Spouse

Date residency began

Date residency ended

Date residency began

Date residency ended

(MM-DD-YY)

(MM-DD-YY)

(MM-DD-YY)

(MM-DD-YY)

Fill in circle(s) if you or your spouse were nonresidents of North Carolina for the entire year.

Part-year residents must read the instructions on Page 14 and complete the worksheet on Page 15 to determine the amounts to enter on Lines 54 and 55 below.

54. Enter the amount from Column B, Line 33 of the Part-Year

54.

Resident/Nonresident Worksheet on Page 15 of the Instructions.

55.

Enter the amount from Column A, Line 33 of the Part-Year

55.

Resident/Nonresident Worksheet on Page 15 of the Instructions.

56. Divide Line 54 by Line 55

(Enter the result as a decimal amount here and on Line 12; round

56.

to four decimal places.)

I certify that, to the best of my knowledge, this return is

If prepared by a person other than taxpayer, this certification is

accurate and complete.

based on all information of which the preparer has any knowledge.

Your Signature

Date

Paid Preparer’s Signature

Date

Spouse’s Signature (If filing joint return, both must sign.)

Date

Preparer’s FEIN, SSN, or PTIN

Home Telephone Number (Include area code.)

Preparer’s Telephone Number (Include area code.)

N.C. DEPT. OF REVENUE

If you ARE NOT due a

N.C. DEPT. OF REVENUE

If REFUND mail

P.O. BOX R

refund, mail return, any

P.O. BOX 25000

return to:

RALEIGH, NC 27634-0001

payment, and D-400V to:

RALEIGH, NC 27640-0640

Original Return Payment Options

Online – You can pay your tax online by bank draft, credit, or debit card using Visa or MasterCard. Go to our website at

and click on Electronic Services for details.

Payment voucher – If you do not pay your tax online, go to our website and generate a personalized Form D-400V. Enclose the

voucher with your return and payment, and mail to the address listed above. If you do not pay online or by payment voucher, mail

a check or money order with your return for the full amount due. Please write “D-400”, and your name, address, and social security

number on the payment. If filing a joint return, write both social security numbers on your payment in the order that they appear on

the return. Note: The Department will not accept a check, money order, or cashier’s check unless it is drawn on a U.S. (domestic)

bank and the funds are payable in U.S. dollars. Please do not staple, tape, paper clip, or otherwise attach your payment or voucher

to your return or to each other.

Amended Returns

See Form D-400X-WS for the mailing address and payment options for amended returns.

Important: You must complete and attach the corrected Form D-400 behind Form D-400X-WS, Worksheet for Amending Individual

Income Tax Return.

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8