Form Dr-908 - Insurance Premium Taxes And Fees Return - 2014 Page 10

ADVERTISEMENT

DR-908

R. 01/15

Page 10

Name _____________________________________ FEIN _________________________________ Florida Code _____________

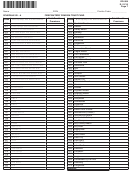

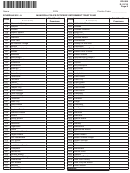

SCHEDULE XIII - B

MUNICIPAL POLICE OFFICERS' RETIREMENT TRUST FUND

Total Taxable

Total Taxable

Code

Code

Municipality

Municipality

Premiums

Premiums

687

North Miami Beach

925

Temple Terrace

690

North Port

926

Tequesta

693

Oakland Park

930

Titusville

695

Ocala

936

Umatilla

701

Ocoee

938

Valparaiso

706

Okeechobee

941

Venice

722

Orange Park

944

Vero Beach

725

Orlando

946

Village of North Palm Beach

728

Ormond Beach

947

Village of Palm Springs

736

Oviedo

954

Wauchula

743

Palatka

963

West Melbourne

744

Palm Bay

966

West Palm Beach

746

Palm Beach Gardens

976

Williston

752

Palmetto

978

Wilton Manors

754

Panama City

984

Winter Garden

755

Panama City Beach

985

Winter Haven

761

Parkland

986

Winter Park

770

Pembroke Pines

773

Pensacola

In addition to completing Schedule XIII, you must answer

776

Perry

Question B on Page 2.

787

Pinellas Park

789

Plantation

Subtotal from Page 9 ......................1.

790

Plant City

796

Pompano Beach

Subtotal from Page 10 ....................2.

801

Port Orange

807

Port St. Lucie

Total Tax ..........................................3.

811

Punta Gorda

[Line 1 plus Line 2 times .85% (.0085).

816

Quincy

Enter here and on Page 1, Line 7] (If zero or less, enter 0)

831

Riviera Beach

836

Rockledge

839

Royal Palm Beach

846

St. Augustine

849

St. Cloud

855

St. Petersburg

856

St. Pete Beach

865

Sanford

867

Sanibel

869

Sarasota

870

Satellite Beach

873

Sebastian

874

Sebring

879

Shalimar

894

South Miami

900

Starke

Use the physical location of

909

Sunrise

911

Surfside

the property when allocating

912

Sweetwater

premiums. Do NOT use ZIP

916

Tallahassee

918

Tampa

codes. For more information,

919

Tamarac

see instructions.

920

Tarpon Springs

921

Tavares

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12