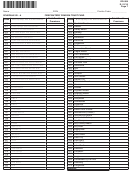

Form Dr-908 - Insurance Premium Taxes And Fees Return - 2014 Page 4

ADVERTISEMENT

DR-908

R. 01/15

Page 4

Name _____________________________________ FEIN _________________________________ Taxable Year _____________

SCHEDULE IV

COMPUTATION OF SALARY CREDIT

*** Include Your Florida Department of Revenue Forms RT-6 and RTS-71 if Claiming this Credit ***

Total Premium Tax Due (Schedule I, Line 11)

1.

Less:

Firefighters’ Pension Trust Fund Credit (Schedule XII - B, Line 3)

2.

Municipal Police Officers’ Retirement Trust Fund Credit (Schedule XIII - B, Line 3)

3.

Corporate Income Tax Paid (Florida Form F-1120, Line 13)

4.

5.

Total (Line 1 minus Line 2 through Line 4)*

Eligible Florida Salaries (See Instructions)

6.

Multiply Line 6 by .15

7.

*

Salary Credit - (Enter the lesser of Line 5 or Line 7 here and on Schedule V, Line 4)

8.

*

If zero or less, enter -0-

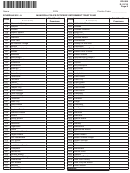

SCHEDULE V

CORPORATE INCOME, SALARY AND SFO CREDIT LIMITATION

Total Corporate Income Tax Paid (Florida Form F-1120, Line 13)**

1.

Less: Corporate Income Tax Credit Taken against Wet Marine and Transportation Insurance Tax

2.

(Schedule XI, Line 5)

3.

Eligible Net Corporate Income Tax (Line 1 minus Line 2)

Salary Credit (Schedule IV, Line 8)

4.

Total Premium Tax Due (Schedule I, Line 11)

5.

Less:

Workers’ Compensation Administrative Assessment Credit (Schedule VI, Line 4)

6.

Firefighters’ Pension Trust Fund Credit (Schedule XII - B, Line 3)

7.

Municipal Police Officers’ Retirement Trust Fund Credit (Schedule XIII - B, Line 3 )

8.

Premium Tax Due After Deductions (Line 5 minus Lines 6 through 8)

9.

Corporate Income Tax and Salary Credit Limitation (Multiply Line 9 by .65)

10.

Eligible Net Corporate Income Tax Credit

11.

*

(Enter the lesser of Line 3 or Line 10 here and on Schedule III, Line 4)

Salary Tax Credit (Enter the lesser of Line 4 or the difference between Lines 10 and 11 here and

*

on Schedule III, Line 5)

A reduction to the salary credit may be required if the election under

12.

s. 624.509(5)(a)2, F.S., applies (see instructions).

Transfer of Enterprise Zone Excess Salary Credit from Affiliate (This line cannot exceed Line 10 minus

13.

Lines 11 and 12. Include attachment per instructions.)

Credit for Contributions to Nonprofit Scholarship Funding Organizations [Enter the lesser of your 2014

eligible contributions plus approved carry forwards or the result of (Schedule V, Line 9 less Lines 11, 12,

14.

and 13) here and on Schedule III, Line 10.] Attach copies of the certificates of contribution from each

nonprofit scholarship funding organization.

*

If zero or less, enter -0-

** If you filed on a consolidated basis for corporate income tax, you MUST include a schedule showing how the credit is

claimed by each subsidiary.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12