Form Dr-908 - Insurance Premium Taxes And Fees Return - 2014 Page 11

ADVERTISEMENT

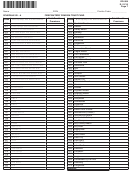

DR-908

R. 01/15

Page 11

Name _____________________________________ FEIN _________________________________ Taxable Year _____________

SCHEDULE XIV

RETALIATORY TAX COMPUTATION

Column A

Column B

State of

State of

Florida*

Incorporation*

1. Net Premium Tax Due (Page 1, Line 3 plus Line 5. See note below)

2. 80% of Salary Tax Credit Taken (Page 3, Schedule III, Line 5)

3. Total Corporate Income Tax (See note below)

4. Enterprise Zone Portion of 20% of Salary Credit Taken (See instructions)

5. Firefighters’ Pension Trust Fund

6. Municipal Police Officers' Retirement Trust Fund

Florida Insurance Guaranty Association (FIGA) (Assessments on the Property Portion of

7.

Insurance Premiums only)

8. Fire Marshal Taxes

9. Annual and Quarterly Statement Filing Fees

10. Annual License Tax and Certificate of Authority

11. Agents' Fees

12. Other Taxes and Fees (Include Schedule)

13. Workers' Compensation Credit

14. Total (Sum of Lines 1 through Line 13)

Retaliatory Tax Due [Line 14, Column B (State of Incorporation) minus Line 14, Column A

15.

*

(State of Florida). Enter here and on Page 1, Line 8.]

NOTE: Compute Column B using the state of incorporation’s tax law to determine tax owed using Florida premiums,

personnel, and property. Attach all applicable returns and schedules.

*

If zero or less, enter -0-

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12