Form Rev-331a As - Authorization Agreement For Electronic Tax Payments Page 2

ADVERTISEMENT

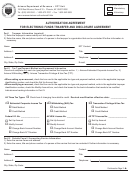

Tax:

9

Check the appropriate block(s) to indicate the tax(es) you will be paying by EFT. Enter the account number for each tax type.

If you select the ACH debit option, the tax type(s) checked should fall under the bank account listed in Section 8 from which

the payment(s) will be drawn.

EIN

1.

Liquid Fuels and Fuels Tax

–

Account Number

2.

Motor Carriers Road Tax

–

Account Number

3.

IFTA - Motor Carriers

–

Account Number

4.

Malt Beverage Tax

Account Number

5.

Cigarette Stamp Agents

Account Number

6.

Pari-Mutuel

License Number

7.

Unstampable Little Cigar Tax

Authorized Signature Information:

10

I certify the information provided on this form is true and correct and authorize the PA Department of Revenue to use the

information herein in direct conjunction with the EFT program.

Print Name: Last

First

M.I.

Title

Date

Signature

Telephone Number

(

)

Make a copy of this completed Authorization Agreement for your records. You may fax your completed Authorization Agreement

to 717-787-0145, or mail it to the PA DEPARTMENT OF REVENUE, PO BOX 280908, HARRISBURG, PA 17128-0908.

For additional information on electronic filing visit or call 717-783-6277. Services for taxpayers

with special hearing and/or speaking needs: 1-800-447-3020 (TT only).

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2