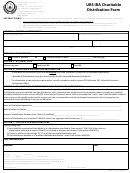

Quest IRA, Inc.

Traditional, SEP, or SIMPLE IRA

17171 Park Row, Suite 100

Houston, TX 77084

Distribution Form

P: 800.320.5950

F: 281.646.9701

Until I give written instructions to the contrary, I direct Quest IRA, Inc. to distribute the amount requested as follows:

Date to commence: ______________________________

Frequency:

[ ] One Time

[ ] Monthly

[ ] Quarterly

[ ] Semi-Annually

[ ] Annually

[ ] Check

Send check to: [ ] Home Address

[ ] Wire

[ ] Different Address: _______________________________________

[ ] ACH

For Wires or ACH:

Name of Bank: __________________________________________ Account Name: ____________________________________

Bank ABA/Routing Number: __________________________________ Account Number: ________________________________

NOTICE OF WITHHOLDING ON DISTRIBUTIONS FROM IRAS

The distributions you receive from your individual retirement account established at this institution are subject to federal income tax

withholding unless you elect not to have withholding apply.

You may elect not to have withholding apply to your distribution payments by completing the “Withholding Election” section above.

If you do not complete the “Withholding Election” section by the date your distribution is scheduled to begin, federal income tax will

be withheld from the amount withdrawn at a rate of 10%.

If you elect not to have withholding apply to your distribution payments, or if you do not have enough federal income tax withheld

from your distribution, you may be responsible for payment of estimated tax. You may incur penalties under the estimated tax rules

if your withholding and estimated tax payments are not sufficient.

WITHHOLDING ELECTION

Option 1.

[ ]

I elect to HAVE federal income taxes withheld from my IRA distribution at the rate of __________ % (not less than

10%) plus an additional amount of $_____________ from the amount withdrawn.

Option 2.

[ ]

I elect to NOT HAVE federal income taxes withheld from my IRA distribution. (Must have a US residence address

on file)

I understand that I am still liable for the payment of federal income tax on the taxable amount. I also understand that I may be

subject to tax penalties under the estimated tax payment rules, if my payments of estimated tax and withholding, if any, are not

adequate.

PAYMENT OF FEES

Payment of fees associated with processing of the distribution shall be paid:

[ ] From Account

[ ] Credit Card Authorization Form attached

Note: There are no applicable fees for required minimum distributions by check.

AUTHORIZATION

I certify that I am the proper party to receive payment(s) from this IRA, and that all information provided by me is true and accurate.

I acknowledge that I have read the Notice of Withholding below and have completed the Withholding Election above. I further

certify that no tax advice has been given to me by Quest IRA, Inc. or the Custodian, that distributions (except certain transfers) are

reported to the IRS, and that all decisions regarding this withdrawal are my own. I expressly assume the responsibility for any

adverse consequences which may arise from this withdrawal and I agree that Quest IRA, Inc. and the Custodian shall in no way be

responsible for those consequences.

Account Holder’s Signature: ______________________________________________ Date:_______ _____________________

Page 2 of 2

1

1 2

2