For additional information, contact the Taxpayer Services Division in one of our Department of Revenue Offices:

Chattanooga

Jackson

Johnson City

Knoxville

Memphis

Nashville

(423) 854-5321

(901) 213-1400

(615) 253-0600

(423) 634-6266

(901) 423-5747

(865) 594-6100

Andrew Jackson Building

Suite 350

Room 405 B

204 High Point Drive

Suite 300

3150 Appling Road

500 Deaderick Street

State Office Building

Lowell Thomas Building

7175 Strawberry

540 McCallie Avenue

225 Martin Luther King Blvd.

Plains Pike

Tennessee residents can also call our statewide toll free number at 1-800-342-1003.

Out-of-state callers must dial (615) 253-0600.

The law governing vending machine sales subject to the gross receipts tax states:

(a) Each person operating any vending machine for the benefit of a charitable nonprofit organization by which merchandise of the market value of

the coin deposited not exceeding twenty-five (25) cents is sold or delivered to customers, shall have the privilege and option of registering with

the Department of Revenue, reporting gross receipts vended through such machines, and paying tax thereon, in lieu of sales tax, at the rate of

one and one-half percent (1.5%) of the gross receipts of the machines.

(b) To comply with the above option, the legal names of the owning entity and the charitable nonprofit organization benefiting from the proceeds

of the machine must appear on each vending machine. Each vending machine must have a permanent registration on forms provided by the

department at a cost for which the department may charge a fee, plus a licensing fee for each individual company registered.

(c) Any person, firm, or corporation engaged in this business operation shall immediately notify the department of its option to pay under this chapter,

and, failing to notify the department, shall pay sales tax as provided by law.

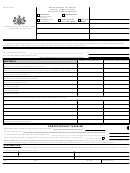

DELINQUENT FILING - (PENALTY AND INTEREST)

Unless this return is postmarked and taxes paid to the Department of Revenue on or before the first day of the second month following the applicable

quarterly filing period (November 1, February 1, May 1, and August 1), penalty and interest will be assessed as required by Tenn. Code Ann. Section

67-1-804.

If payments are not paid by the due date, penalty will be assessed for late payment at the rate of 5% of the amount due for each 30 days (or portion

thereof) that the payment remains unpaid subsequent to the due date, up to a maximum of 25%.

INSTRUCTIONS

Line 3 – A tax credit may be taken for the previous year’s combined franchise, excise tax liability. However, the amount of credit taken cannot exceed

Line 2. Contact the Department of Revenue for instructions.

Line 5 – Credit taken cannot exceed Line 4.

Neither Line 4 nor Line 8 may reflect a negative amount.

INTERNET (8-05)

1

1 2

2