Form Dr-156 - Florida Fuel Or Pollutants Tax Application Page 14

ADVERTISEMENT

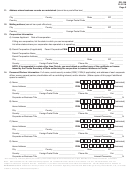

DR-157W

R. 10/13

Page 2

Step #2: Tables A1 and A2 - Terminal Suppliers, Wholesalers, and Exporters: For each fuel type, estimate the average

monthly gallons of fuel to be purchased for delivery in Florida or for export.

Table B - Importers: For each fuel type, estimate the average daily gallons of fuel to be purchased for delivery

in Florida.

Table C - For each pollutant, estimate the average monthly gallons first removed from storage in Florida or first

sold in Florida.

For each type of fuel or pollutant, enter the estimated number of gallons in COLUMN 2 of the applicable

Table(s).

Step #3:

Multiply the estimated gallons from (COLUMN 2) by the tax rate(s) shown in (COLUMN 3). Enter the result in

(COLUMN 4). Tax rates are published annually in Tax Information Publications posted on the Department’s

website at:

Step #4: Multiply the result in COLUMN 4 by the number in COLUMN 5. Enter the result in COLUMN 6. This is your

bond amount.

Step #5: Attach the completed Bond Worksheet to your completed application (Form DR-156).

Bonds and Security

To satisfy bond requirements, you must provide one or more of the following for each bond required.

Fuel or Pollutant Tax Surety Bond (DR-157)

Assignment of Time Deposit (DR-157A)

Fuel or Pollutant Tax Cash Bond (DR-157B)

An irrevocable letter of credit may be submitted to the Department of Revenue instead of a surety bond. An irrevocable

letter of credit must contain the following:

•

The Florida Department of Revenue must be the beneficiary

•

The expiration of the letter of credit must automatically be extended without amendment for a one-year period

unless otherwise authorized in writing by the Department

If the letter of credit is to cover more than one fuel product type, a cover letter of explanation must be provided.

At least 60 days prior to any expiration or termination of the letter of credit, the bank or savings association must notify

the Department of the expiration or termination.

Contact Us

Information, forms, and tutorials are available on the Department’s website at:

If you have questions, contact Taxpayer Services at 850-488-6800, Monday through Friday, excluding holidays.

For written replies to tax questions, write:

Taxpayer Services – Mail Stop 3-2000

Florida Department of Revenue

5050 W Tennessee St

Tallahassee FL 32399-0112

Subscribe to our tax publications to receive due date reminders or an e-mail when we post:

• Tax Information Publications (TIPs).

• Proposed rules, notices of rule development workshops, and more.

Go to:

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19