Form Dr-156 - Florida Fuel Or Pollutants Tax Application Page 6

ADVERTISEMENT

DR-156

R. 01/18

Page 3

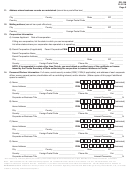

15.

Carrier Information

A) Do you transport petroleum products/fuels

over the highways and/or waterways of Florida? ............. o YES ........... o NO .......................... If “ NO,” go to question 16.

If “YES,” are you a common carrier? ................................ o YES ........... o NO .......................... If “ NO,” go to question 15(B)

If “YES,” what mode of transportation

is used to transport the fuel/petroleum products?

o Truck

o Rail

o Vessel

o Pipeline

B) If you are not a common carrier, list the make/model, year, vehicle identification number, and total tanker capacity of each

truck, barge, boat, or other equipment used to transport fuel on the highways or waterways of Florida. Cab cards will be

issued for each motor vehicle or item of equipment used to transport fuel. (If necessary, attach a separate sheet.)

Make/Model

Year

Vehicle ID Number

Tanker Capacity (in Gallons)

16.

Fuel Storage Information

Answer all questions. DO NOT leave any blank.

1) Do you have a through-put agreement? ...............................................................................................o YES o NO

2) Do you deliver fuel directly to retail locations? ......................................................................................o YES o NO

3) Do you own, operate or lease any bulk storage tanks in Florida? ........................................................ o YES o NO

If “YES” to 3, list all below and indicate whether it is owned or leased:

Tank Capacity

*DEP Number

Physical Location (Address)

Own/Lease

(in Gallons)

* “DEP number” means the facility identification number assigned by the Florida Department of Environmental Protection to your location.

DEP numbers are not assigned to Natural Gas dealers. (If necessary, attach a separate sheet.)

17.

Pollutants Storage Information

Will this business produce, import, or remove petroleum pollutants through a terminal rack in Florida? o YES o NO

If “YES” (check appropriate box(es)):

Produce

Import or cause to be imported (into Florida)

Export

o

o

o

Be entitled to a refund on the following taxable pollutants:

o

Petroleum Products

Ammonia o

Pesticides o

Chlorine

o

o

Motor Oil or Other Lubricants o

Crude Oil o

Solvents

Perchloroethylene

o

o

Other (specify) ___________________________________________________________________________________

o

List the type of pollutant, location of storage facility, and estimated volume of taxable units imported, produced, or

sold in Florida.

Type of Pollutant

Location of Storage Facility

Taxable Units

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19