Form Dr-156 - Florida Fuel Or Pollutants Tax Application Page 7

ADVERTISEMENT

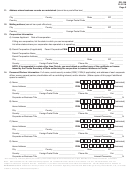

DR-156

R. 01/18

Page 4

18.

Bond Information - Attach a completed DR-157W (Bond Worksheet)

19.

List all suppliers of pollutants.

Name of Supplier

License Number

Licensing Information

20. A) Do you sell or supply natural gas at retail for use in motor vehicles? ------------------------------------- o YES o NO

B) Do you purchase natural gas fuel for use in a motor vehicle from someone other than a natural gas fuel

retailer (e.g., a mass transit or waste management company who owns and operates their own filling

station)?

If use is limited to one or more of the following, do not answer “Yes”:

• You purchase natural gas fuel for agricultural purposes.

• You receive natural gas fuel from a personal refueling device located at your primary residence.

• You are a state, local, or federal government entity who purchases and uses natural gas fuel in

------------------------------------------------------------------------------- o YES o NO

government owned vehicles.

C) If you answered “YES” to question 20A or 20B, provide the physical location and the type of natural gas

fuel used or sold. If you have more than 5 locations, attach a separate sheet to your application listing the

physical address and activity type for each location.

Station No.

Physical Address of Retail Station

Activity Type *

1

2

3

4

5

* Activity type is defined as liquefied petroleum gas products (LPG), compressed natural gas products (CNG),

or a combination thereof (LPG/CNG) for use in a motor vehicle.

21. A) Do you wholesale motor, diesel, or aviation fuel? - -------------------------------------------------------- o YES o NO

B) If “YES,” do you have (or have you applied for) a wholesaler license? ------------------------------- o YES o NO

22. Are you a county, municipality, or school district that uses untaxed diesel fuel in motor vehicles? - ------ o YES o NO

23. Are you a mass transit system providing local bus service that is open to the public and travels

regular routes? --------------------------------------------------------------------------------------------------- o YES o NO

24. A) Do you have a valid refund permit number? -------------------------------------------------------------- o YES o NO

B) If “YES,” what is your refund permit number? ------------------------------------------------------------ _________________

25. A) Are you registered to collect and/or remit sales tax? ---------------------------------------------------- o YES o NO

B) If “YES,” what is your sales tax registration number? ---------------------------------------------------- _________________

26. Will this business import fuels into Florida upon which there has been no precollection of Florida tax? - o YES o NO

27. A) Are you registered as a Position Holder under section 4101 of the Internal Revenue Code for

transactions involving the storage and transfer of motor and/or diesel fuel(s)? ----------------------- o YES o NO

B) If “YES,” what is your federal fuel registration number? - ------------------------------------------------- ________________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19