Form Dr-156 - Florida Fuel Or Pollutants Tax Application Page 17

ADVERTISEMENT

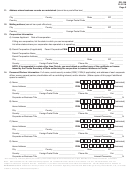

DR-157

MAIL TO:

FLORIDA DEPARTMENT OF REVENUE

Fuel or Pollutants Tax Surety Bond

R. 10/13

ACCOUNT MANAGEMENT - FUEL UNIT

TC

MS 1-5730

5050 W. TENNESSEE ST.

Rule 12B-5.150

Florida Administrative Code

TALLAHASSEE, FL 32399-0160

Effective 01/14

Please complete and submit an original bond form for each fuel product type or taxable pollutant. An applicant cannot

be issued a fuel license by the Department of Revenue until the proper security is submitted. An importer’s bond is

required in addition to a wholesaler’s bond pursuant to Rule 12B-5.030, F.A.C. If further information is needed, please

contact Account Management - Fuel Unit at 850-488-6800.

State of ______________ County of _____________________________bond number __________________________________

We, ____________________________________________, as principal, and __________________________________________ ,

(name of principal)

(name of surety)

as surety, are bound to the Florida Department of Revenue on behalf of the State of Florida, in the sum of

$ _____________________________ for the payment of which we bind ourselves, our successors and assigns, heirs, and

personal representatives, jointly and severally.

Principal acknowledges that _________________ is engaged in business which is subject to the Florida Statute

(he, she, it)

identified below: (Please check the appropriate box.)

(

) Motor fuel pursuant to Chapter 206, F.S.

(

) Pollutants tax pursuant to Chapter 206, F.S.

(

) Diesel fuel pursuant to Chapter 206, F.S.

(

) Importer’s bond pursuant to section 206.051, F.S.

(

) Aviation fuel pursuant to Chapter 206, F.S. (

) Alternative fuel pursuant to Chapter 206, F.S.

THE CONDITION OF THIS BOND is that if the principal faithfully complies with the Florida statutory tax provisions

regarding such business of the principal then this bond is void; otherwise it remains in force.

The surety agrees that if the surety wishes to cancel the bond, notification must be submitted in writing to the

Department of Revenue. Surety will mail the cancellation notice to:

FLORIDA DEPARTMENT OF REVENUE

-

ACCOUNT MANAGEMENT

FUEL UNIT MS 1-5730

5050 W. TENNESSEE ST.

TALLAHASSEE, FLORIDA 32399-0160

The bond will be cancelled sixty (60) days after the Department receives notification. The surety is liable for acts

committed by the principal and covered by the terms of the bond until it is cancelled.

This bond shall be effective as of the _________ day of _____________________________, ______

(month)

(year)

__________

____________________ , _______ .

Signed this

day of

(month)

(year)

As Principal

_____________________________________________

For DOR Use Only

By

(Principal’s name)

As Surety

_____________________________________________

By

Accepted this ______ day of ________________, ______ .

(Surety’s name)

(month)

(year)

_____________________________________________

Florida Department of Revenue

(Surety’s FEIN)

_____________________________________________

By _______________________________________________

(Surety’s address)

Name

_____________________________________________

(City, State, ZIP)

__________________________________________________

_____________________________________________

By

Title

As Attorney-In-Fact and Florida Resident Agent for Surety

(Authority of Attorney-In-Fact and Florida

Account Number: __________________________________

Resident Agent must be attached)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19