Form Dr-156 - Florida Fuel Or Pollutants Tax Application Page 9

ADVERTISEMENT

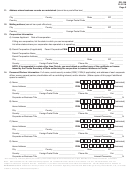

DR-156

R. 01/18

Page 6

40. Describe any affiliation between your company and its primary supplier or customer.

41. Is an occupational license required by the city or county for your business location? If yes, attach a copy of the current

license.

42. If you do not own the property where the business is located or will operate, please provide the name and telephone number

of the owner of the property.

43. Other than the address on your application, list all other locations in Florida that your company or representative maintains.

44. Are you currently associated with any fuel business that is located in other states or the State of Florida? List the state name,

company name, and state license type.

45. Are your corporate officers involved or have interest in any other fuel related businesses in any state, including Florida? If so,

list company name, company address, officer’s name.

46. Have you ever been denied a license in any state, including Florida? If so, explain why.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19