Form Dr-156 - Florida Fuel Or Pollutants Tax Application Page 5

ADVERTISEMENT

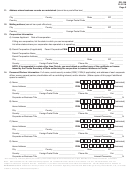

DR-156

R. 01/18

Page 2

11.

Address where business records are maintained (cannot be a post office box) _______________________________________

_______________________________________________________________________________________________________________

City ____________________________

County _______________________________

State ____________

ZIP ___________

Country _____________________________________________

Foreign Postal Code _____________________________________

12.

Mailing address (cannot be a post office box) ______________________________________________________________________

City ____________________________

County _______________________________

State ____________

ZIP ___________

Country _____________________________________________

Foreign Postal Code _____________________________________

13.

Corporation Information

A) License Applicant: Date of Incorporation ______________________________________________________________________

If filing as a corporation, list the state in which you are incorporated: ________________________________________________

List other states where your corporation has operated or is operating: _______________________________________________

–

B) Parent Corporation (if applicable) Parent Corporation FEIN

Parent Corporation Name ______________________________________________________________________________________

Parent Corporation Address ____________________________________________________________________________________

City _________________________

County _______________________________

State ____________

ZIP ___________

Country ________________

Foreign Postal Code ________________

Phone No. ___________________ Ext. ________

NOTE: If incorporated in a state other than Florida, you must attach a certified copy of the certificate or license

issued by the Florida Secretary of State authorizing the corporation to transact business in Florida.

14.

Personnel/Partner Information: Full name, social security number (SSN)*, FEIN (if applicable), and address of each corporate

officer, owner, general partner, stockholder with a controlling interest, and/or director. (Make copies of this page if additional

space is needed.)

–

–

SSN

A) Name ______________________________________________________

(Individual)

–

FEIN

Home Address ______________________________________________

(Business)

City _________________________

County _______________________________

State ____________

ZIP ___________

Country ________________

Foreign Postal Code ________________

Phone No. ___________________ Ext. ________

Corporate or Business Title _______________________________________________________ Interest/Ownership __________%

–

–

B) Name ______________________________________________________

SSN

(Individual)

–

Home Address ______________________________________________

FEIN

(Business)

City _________________________

County _______________________________

State ____________

ZIP ___________

Country ________________

Foreign Postal Code ________________

Phone No. ___________________ Ext. ________

Corporate or Business Title _______________________________________________________ Interest/Ownership __________%

–

–

C) Name ______________________________________________________

SSN

(Individual)

–

FEIN

Home Address ______________________________________________

(Business)

City _________________________

County _______________________________

State ____________

ZIP ___________

Country ________________

Foreign Postal Code ________________

Phone No. ___________________ Ext. ________

Corporate or Business Title _______________________________________________________ Interest/Ownership __________%

–

–

D) Name ______________________________________________________

SSN

(Individual)

–

FEIN

Home Address ______________________________________________

(Business)

City _________________________

County _______________________________

State ____________

ZIP ___________

Country ________________

Foreign Postal Code ________________

Phone No. ___________________ Ext. ________

Corporate or Business Title _______________________________________________________ Interest/Ownership __________%

* Social security numbers (SSNs) are used by the Florida Department of Revenue as unique identifiers for the administration of Florida’s

taxes. SSNs obtained for tax administration purposes are confidential under sections 213.053 and 119.071, Florida Statutes, and not

subject to disclosure as public records. Collection of your SSN is authorized under state and federal law. Visit the Department’s website at:

and select “Privacy Notice” for more information regarding the state and federal law governing the collection, use, or release

of SSNs, including authorized exceptions.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19