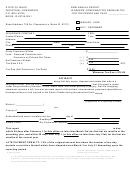

Form Nyc-Fp - Annual Report Of Fire Premiums Tax Upon Foreign And Alien Insurers - 2017 Page 3

ADVERTISEMENT

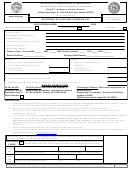

INSTRUCTIONS - Form NYC-FP - Annual Report of Fire Premiums Tax Upon Foreign and Alien Insurers

page 1

G E N E R A L I N F O R M AT I O N

WHEN AND WHERE TO FILE

The report and all accompanying documents, including

payment, must be filed and postmarked on or before March

DEFINITIONS

1, covering the preceding tax year from January 1 to

1. “Alien Insurer” Any insurer incorporated or organ-

December 31.

ized under the laws of any foreign nation, or of any

province or territory not included under the defini-

All returns:

NYC Department of Finance

tion of a foreign insurer.

P.O. Box 5564

Binghamton, NY 13902-5564

2. “Foreign Insurer” Any insurer, except a mutual

insurance company taxed under the provisions of

Remittances: Pay online with Form NYC-200V at

Section 9105 of the Insurance Law, incorporated or

nyc.gov/eservices

organized under the laws of any state, as herein

defined, other than this state.

OR

Mail payment and Form NYC-200V only to:

3. “Fire insurance corporation, association or indi-

NYC Department of Finance

viduals” Any insurer, regardless of the name, desig-

P.O. Box 3933

nation or authority under which it purports to act,

New York, NY 10008-3933

which insures property of any kind or nature against

loss or damage by fire.

PLACE OF BUSINESS TO BE REPORTED

Any change in principal place of business or termination

4. “Loss or damage by fire” Loss or damage by fire,

of any office or place of business in New York City must

lightning, smoke, or anything used to combat fire,

be reported within 15 days after the change or termination.

regardless of whether such risks or the premiums

therefore are stated or charged separately and apart

S P E C I F I C I N S T R U C T I O N S

from any other risk or premium.

NEW! - Fair Plan Filers

5. “State” Any state of the United States and the

Participants in the New York State Department of

District of Columbia.

Financial Services’ “Fair Plan” program, complete

Schedule B based on the information contained in

REQUIREMENTS FOR FILING

their annual Fair Plan Tax Distribution Report, and

Every foreign and alien insurer is required, pursuant to

transfer the distributable tax amount to Schedule A,

the provisions of Title 11, Chapter 9 of the NYC

line 9. Attach a copy of the Fair Plan Distribution

Administrative Code, to pay to the Department of

Report to this return.

Finance on or before March 1 following the close of the

previous tax year (January 1 to December 31) the amount

NOTE:

Page 2 of Form NYC-FP which formerly

of 2% of net New York City premiums (all New York

required each filer to list complete names, principal busi-

City premiums, less return premiums) received or writ-

ness addresses and employer identification numbers for all

ten from January 1 to December 31 for any insurance

members of a group and the amount of tax paid has been

against loss or damage by fire on real or personal prop-

deleted because EACH INSURER IS REQUIRED TO

erty in the City of New York (including that portion of

FILE ITS OWN FORM SEPARATELY. Thus, each

fire premiums in automobile and multiple peril policies

member of a group must file a separate return.

which insures against loss or damage by fire) and to file

with the Department of Finance, at the time of paying the

SCHEDULE A - COMPUTATION OF TAX

tax, a verified report setting forth the net New York City

LINES 1 THROUGH 6 - NET PREMIUMS/TAX-

premiums upon which the tax is payable. If no premiums

ABLE PREMIUMS

were received during the tax year, a letter to that effect,

1. Enter on line 1 through line 6, in column A, the New

signed by an official of the insurer, is to be submitted.

York City net premiums (all New York City premi-

Any insurer engaged solely in reinsurance is required to

ums, less return premiums) received or written from

submit an affidavit stating that its transactions are

January 1 to December 31 in the year preceding the

restricted to reinsurance and that it has not issued any

due date of the return for any insurance against loss

direct policies in the City of New York.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4