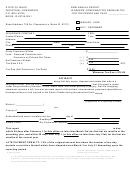

Form Nyc-Fp - Annual Report Of Fire Premiums Tax Upon Foreign And Alien Insurers - 2017 Page 4

ADVERTISEMENT

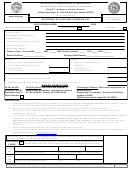

INSTRUCTIONS - Form NYC-FP - Annual Report of Fire Premiums Tax Upon Foreign and Alien Insurers

page 2

LINE 12 - TOTAL REMITTANCE DUE

or damage on real or personal property in the City of

New York, including any automobile and multiple

Enter on line 12, column C, the total of lines 8, 9, 10 and

peril policies which insure against loss or damage.

11, column C. Enter the amount of payment remitted

with this return on line A, in the space provided.

2. Enter on line 1 through line 6, column B, the per-

Payment must be made in U.S. dollars, drawn on a U.S.

centages of the net New York City premiums attrib-

bank. Make remittance payable to the order of:

utable to fire insurance and to be applied to column

NYC DEPARTMENT OF FINANCE

A in order to arrive at the taxable premiums, line 1

through line 6, column C.

NOTE: All books and records, schedules and working

papers used in the preparation of the return must be

LINE 7 - TOTAL TAXABLE PREMIUMS

retained and made available for inspection upon demand

Enter on line 7, column C, the total taxable premiums

by the Department of Finance. A notice “Records

(the sum of line 1 through line 6, column C).

Required for Audit of Tax on Premiums on Policies of

LINE 8 - TOTAL TAX DUE

Foreign and Alien Insurers” (Form FP-I) will be mailed

Enter on line 8, column C, the total tax due (2 % of line

upon request.

7, column C).

For further information, call 311. If calling from outside

LINE 10 - INTEREST

of the five NYC boroughs, please call 212-NEW-YORK

If the tax is not paid on or before the due date (determined

(212-639-9675).

without regard to any extension of time), interest must be

Preparer Authorization: If you want to allow the

paid on the amount of the underpayment from the due date

Department of Finance to discuss your return with the

to the date paid. For information as to the applicable rate

paid preparer who signed it, you must check the “yes”

of interest, call 311. If calling from outside of the five

box in the signature area of the return. This authorization

NYC boroughs, please call 212-NEW-YORK (212-639-

applies only to the individual whose signature appears in

9675). Interest amounting to less than $1 need not be paid.

the “Preparer’s Use Only” section of your return. It does

LINE 11 - ADDITIONAL CHARGES/PENALTIES

not apply to the firm, if any, shown in that section. By

a) If you fail to file a return when due, add to the tax

checking the “Yes” box, you are authorizing the

(less any payments made on or before the due date or

Department of Finance to call the preparer to answer any

any credits claimed on the return) 5% for each month

questions that may arise during the processing of your

•

or partial month the return is late, up to 25%, unless

return. Also, you are authorizing the preparer to:

the failure is due to reasonable cause.

Give the Department any information missing from

•

your return,

b) If the return is filed more than 60 days late, the min-

imum late filing penalty will not be less than the

Call the Department for information about the pro-

lesser of a) $100 or b) 100% of the amount required

cessing of your return or the status of your refund or

to be shown as tax due on the return (less any pay-

•

payment(s), and

ments or credits claimed).

Respond to certain notices that you have shared with

c) If you fail to pay the tax shown on the return by the

the preparer about math errors, offsets, and return

prescribed filing date, add to the tax (less any pay-

preparation. The notices will not be sent to the preparer.

ments made or any credits claimed on the return) 1/2%

for each month or partial month the payment is late up

You are not authorizing the preparer to receive any

to 25%, unless the failure is due to reasonable cause.

refund check, bind you to anything (including any addi-

tional tax liability), or otherwise represent you before the

d) The total of the additional charges in a) and c) may not

Department. The authorization cannot be revoked, how-

exceed 5% for any one month except as provided for in b).

ever, the authorization will automatically expire no later

than the due date (without regard to any extensions) for

If you claim not to be liable for these additional charges,

filing next year's return. Failure to check the box will

attach a statement to your return explaining the delay in

be deemed a denial of authority.

filing, payment or both.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4