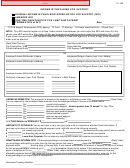

Instructions For Income Withholding For Support Page 2

ADVERTISEMENT

•

Amount to withhold is not a dollar amount.

•

Sender has not used the OMB-approved form for the IWO.

•

A copy of the underlying order is required and not included.

If you receive this document from an attorney or private individual/entity, a copy of the underlying support

order containing a provision authorizing income withholding must be attached.

COMPLETED BY SENDER:

1g.

State/Tribe/Territory. Name of state or tribe sending this form. This must be a governmental

entity of the state or a tribal organization authorized by a tribal government to operate a CSE

program. If you are a tribe submitting this form on behalf of another tribe, complete field 1i.

.

1h

Remittance ID (include w/payment). Identifier that employers/income withholders must include

when sending payments for this IWO. The Remittance ID is entered as the case identifier on the

electronic funds transfer/electronic data interchange (EFT/EDI) record.

NOTE TO EMPLOYER/INCOME WITHHOLDER:

The employer/income withholder must use the Remittance ID when remitting payments so the SDU or

tribe can identify and apply the payment correctly. The Remittance ID is entered as the case identifier on

the EFT/EDI record.

COMPLETED BY SENDER:

1i.

City/County/Dist./Tribe. Optional field for the name of the city, county, or district sending this

form. If entered, this must be a government entity of the state or the name of the tribe authorized

by a tribal government to operate a CSE program for which this form is being sent. If a tribe is

submitting this form on behalf of another tribe, enter the name of that tribe.

1j.

Order ID. Unique identifier associated with a specific child support obligation. It could be a court

case number, docket number, or other identifier designated by the sender.

1k.

Private Individual/Entity. Name of the private individual/entity or non-IV-D tribal CSE

organization sending this form.

1l.

Case ID. Unique identifier assigned to a state or tribal CSE case. In a state IV-D case as defined

at 45 Code of Federal Regulations (CFR) 305.1, this is the identifier reported to the Federal Case

Registry (FCR). One IWO must be issued for each IV-D case and must use the unique CSE

Agency Case ID. For tribes, this would be either the FCR identifier or other applicable identifier.

Fields 2 and 3 refer to the employee/obligor’s employer/income withholder and specific case information.

2a.

Employer/Income Withholder's Name. Name of employer or income withholder.

2b.

Employer/Income Withholder's Address. Employer/income withholder's mailing address

including street/PO box, city, state, and zip code. (This may differ from the employee/obligor’s

work site.) If the employer/income withholder is a federal government agency, the IWO should be

sent to the address listed under Federal Agency Income Withholding Contacts and Program

Information at

information.

2c.

Employer/Income Withholder's FEIN. Employer/income withholder's nine-digit Federal

Employer Identification Number (if available).

_________________________________________________________________________________________________________

INCOME WITHHOLDING FOR SUPPORT – Instructions

Page 2 of 7

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2 3

3 4

4 5

5 6

6 7

7