Instructions For Income Withholding For Support Page 5

ADVERTISEMENT

NOTE TO EMPLOYER/INCOME WITHHOLDER:

The employer/income withholder may not withhold more than the lesser of: 1) the amounts allowed by

the Federal Consumer Credit Protection Act [15 USC §1673(b)]; or 2) the amounts allowed by the

jurisdiction of the employee/obligor’s principal place of employment (i.e., the amounts allowed by state

law if the employee/obligor’s principal place of employment is in a state; or the amounts allowed by tribal

law if the employee/obligor’s principal place of employment is under tribal jurisdiction). State-specific

withholding limitations, time requirements, and any allowable employer fees are available at

For tribe-

specific contacts, payment addresses, and withholding limitations, please contact the tribe at

or

https://

A federal government agency may withhold from a variety of incomes and forms of payment, including

voluntary separation incentive payments (buy-out payments), incentive pay, and cash awards. For a

more complete list, see 5 CFR 581.103.

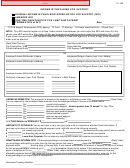

COMPLETED BY SENDER:

21.

State/Tribe. Name of the state or tribe sending this document.

22.

Locator Code. Geographic Locator Codes are standard codes for states, counties, and cities

issued by the National Institute of Standards and Technology. These were formerly known as

Federal Information Processing Standards (FIPS) codes.

23.

SDU/Tribal Order Payee. Name of SDU (or payee specified in the underlying tribal support

order) to which payments must be sent.

24.

SDU/Tribal Payee Address. Address of the SDU (or payee specified in the underlying tribal

support order) to which payments must be sent.

COMPLETED BY EMPLOYER/INCOME WITHHOLDER:

25.

Return to Sender Checkbox. The employer/income withholder should check this box and return

the IWO to the sender if this IWO is not payable to an SDU or Tribal Payee or this IWO is not

regular on its face as indicated on page 1 of these instructions.

COMPLETED BY SENDER IF REQUIRED BY STATE OR TRIBAL LAW:

26.

Signature of Judge/Issuing Official. Signature of the official authorizing this IWO.

27.

Print Name of Judge/Issuing Official. Name of the official authorizing this IWO.

28.

Title of Judge/Issuing Official. Title of the official authorizing this IWO.

29.

Date of Signature. Date the judge/issuing official signs this IWO.

30.

Copy of IWO checkbox. Check this box for all intergovernmental IWOs. If checked, the

employer/income withholder is required to provide a copy of the IWO to the employee/obligor.

ADDITIONAL INFORMATION FOR EMPLOYERS/INCOME WITHHOLDERS

The following fields refer to federal, state, or tribal laws that apply to issuing an IWO to an

employer/income withholder. State- or tribal-specific information may be included only in the fields below.

_________________________________________________________________________________________________________

INCOME WITHHOLDING FOR SUPPORT – Instructions

Page 5 of 7

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2 3

3 4

4 5

5 6

6 7

7