Instructions For Income Withholding For Support Page 3

ADVERTISEMENT

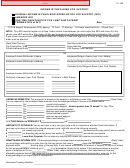

3a.

Employee/Obligor’s Name. Employee/obligor’s last name and first name. A middle name is

optional.

3b.

Employee/Obligor’s Social Security Number. Employee/obligor’s Social Security number or

other taxpayer identification number.

3c.

Employee/Obligor’s Date of Birth. Employee/obligor’s date of birth is optional.

3d.

Custodial Party/Obligee’s Name. Custodial party/obligee’s last name and first name. A middle

name is optional. Enter one custodial party/obligee’s name on each IWO form. Multiple

custodial parties/obligees are not to be entered on a single IWO. Issue one IWO per state IV-D

case as defined at 45 CFR 305.1.

3e.

Child(ren)’s Name(s). Child(ren)’s last name(s) and first name(s). A middle name(s) is

optional. (Note: If there are more than six children for this IWO, list additional children’s names

and birth dates in the Supplemental Information section). Enter the child(ren) associated with

the custodial party/obligee and employee/obligor only. Child(ren) of multiple custodial

parties/obligees is not to be entered on an IWO.

3f.

Child(ren)’s Birth Date(s). Date of birth for each child named.

3g.

Blank box. Space for court stamps, bar codes, or other information.

ORDER INFORMATION – Field 4 identifies which state or tribe issued the order. Fields 5 through 12

identify the dollar amounts for specific kinds of support (taken directly from the support order) and the

total amount to withhold for specific time periods.

4.

State/Tribe. Name of the state or tribe that issued the support order.

5a-b.

Current Child Support. Dollar amount to be withheld per the time period (for example, week,

month) specified in the underlying support order.

6a-b.

Past-due Child Support. Dollar amount to be withheld per the time period (for example, week,

month) specified in the underlying support order.

6c.

Arrears Greater Than 12 Weeks? The appropriate box (Yes/No) must be checked indicating

whether arrears are greater than 12 weeks.

7a-b.

Current Cash Medical Support. Dollar amount to be withheld per the time period (for example,

week, month) specified in the underlying support order.

8a-b.

Past-due Cash Medical Support. Dollar amount to be withheld per the time period (for

example, week, month) specified in the underlying support order.

9a-b.

Current Spousal Support. (Alimony) Dollar amount to be withheld per the time period (for

example, week, month) specified in the underlying support order.

10a-b. Past-due Spousal Support. (Alimony) Dollar amount to be withheld per the time period (for

example, week, month) specified in the underlying order.

11a-c. Other. Miscellaneous obligations dollar amount to be withheld per the time period (for example,

week, month) specified in the underlying order. Must specify a description of the obligation (for

example, court fees).

12a-b. Total Amount to Withhold. The total amount of the deductions per the corresponding time

period. Fields 5a, 6a, 7a, 8a, 9a, 10a, and 11a should total the amount in 12a.

_________________________________________________________________________________________________________

INCOME WITHHOLDING FOR SUPPORT – Instructions

Page 3 of 7

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2 3

3 4

4 5

5 6

6 7

7