Instructions For Income Withholding For Support Page 4

ADVERTISEMENT

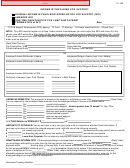

NOTE TO EMPLOYER/INCOME WITHHOLDER:

An acceptable method of determining the amount to be paid on a weekly or biweekly basis is to multiply

the monthly amount due by 12 and divide that result by the number of pay periods in a year. Additional

information about this topic is available in

Action Transmittal

16-04, Correctly Withholding Child Support

from Weekly and Biweekly Pay Cycles

(https://

support-from-weekly-and-biweekly-pay-cycles).

COMPLETED BY SENDER:

AMOUNTS TO WITHHOLD - Fields 13a through 13d specify the dollar amount to be withheld for this

IWO if the employer/income withholder’s pay cycle does not correspond with field 12b.

13a.

Per Weekly Pay Period. Total amount an employer/income withholder should withhold if the

employee/obligor is paid weekly.

13b.

Per Semimonthly Pay Period. Total amount an employer/income withholder should withhold if

the employee/obligor is paid twice a month.

13c.

Per Biweekly Pay Period. Total amount an employer/income withholder should withhold if the

employee/obligor is paid every two weeks.

13d.

Per Monthly Pay Period. Total amount an employer/income withholder should withhold if the

employee/obligor is paid once a month.

14.

Lump Sum Payment. Dollar amount withheld when the IWO is used to attach a lump sum

payment. This field should be used when field 1c is checked.

.

15

Document Tracking ID. Optional unique identifier for this form assigned by the sender.

Please Note: Employer’s Name, FEIN, Employee/Obligor’s Name and SSN, Case ID, and Order ID must

appear in the header on page two and subsequent pages.

REMITTANCE INFORMATION - Payments are forwarded to the SDU in each state, unless the initial child

support order was entered by a state before January 1, 1994 and never modified, accrued arrears, or was

enforced by a child support agency or by a tribal CSE agency. If the order was issued by a tribal CSE

agency, the employer/income withholder must follow the remittance instructions on the form.

16.

State/Tribe. Name of the state or tribe sending this document.

17.

Days. Number of days after the effective date noted in field 18 in which withholding must begin

according to the state or tribal laws/procedures for the employee/obligor’s principal place of

employment.

18.

Date. Effective date of this IWO.

19.

Business Days. Number of business days within which an employer/income withholder must

remit amounts withheld pursuant to the state or tribal laws/procedures of the principal place of

employment.

20.

Percentage of Disposable Income. The percentage of disposable income that may be withheld

from the employee/obligor’s paycheck. It is the sender’s responsibility to determine the

percentage an employer/income withholder is required to withhold.

_________________________________________________________________________________________________________

INCOME WITHHOLDING FOR SUPPORT – Instructions

Page 4 of 7

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2 3

3 4

4 5

5 6

6 7

7